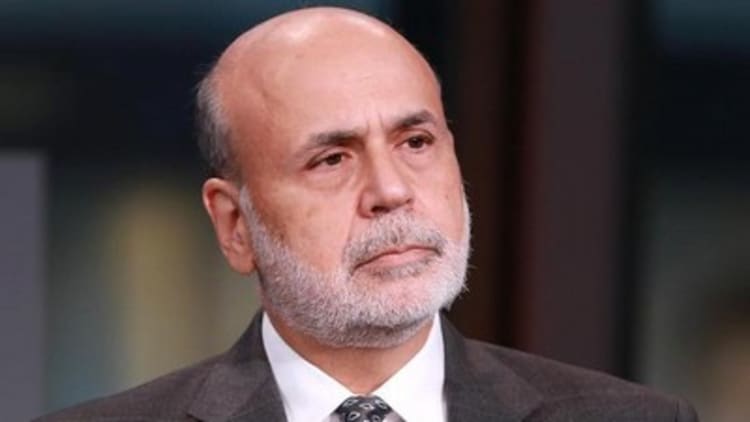

The Federal Reserve should pay close attention to the market's view on interest rates, Ben Bernanke said Wednesday at a Wall Street Journal event.

The former Fed chairman also said the central bank faces "a tough call" on whether or not it should raise interest rates for the first time in nearly a decade, the Journal said.

He said the "next few months" will determine if the U.S. economy stays on track, and he reiterated the importance of bringing inflation back up.

Bernanke made similar comments on CNBC's "Squawk Box" on Monday. "[The Fed] has a 2 percent inflation target. It needs to get inflation up to that target," he said.

Bernanke said Wednesday he remained optimistic the Fed would bring inflation up to its 2 percent target.

He said a key issue is emerging markets, echoing recent comments by the leaders of the International Monetary Fund and the World Bank.

The IMF's Christine Lagarde said last week that the fund expects emerging market economies to post their fifth-consecutive year of declining growth rates. World Bank President Jim Yong Kim also said last week emerging markets will experience slower growth in the near future.

Bernanke acknowledged that the Fed does not have "terrific tools" to to face a new economic downturn and that it would want fiscal assistance if one ever arose.

Nonetheless, he said he does not see any major bubble risks, adding: "We have a pretty good domestic expansion."

— CNBC's Matthew J. Belvedere contributed to this report.