Congratulations, America.

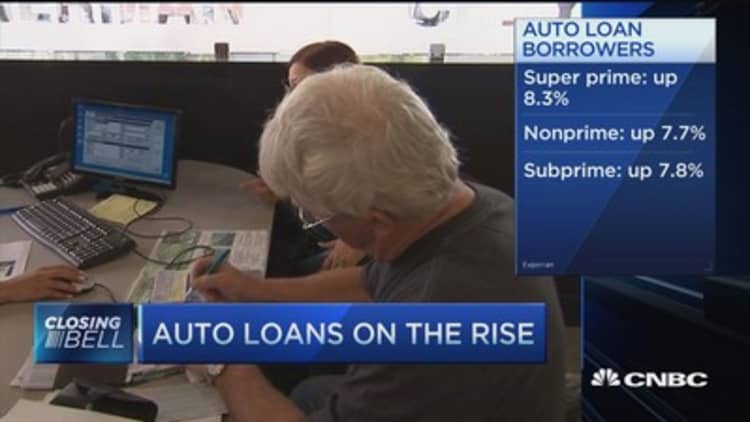

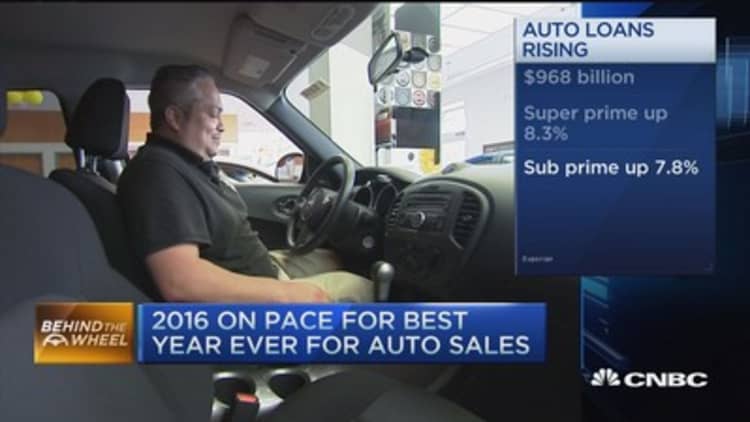

The amount of money borrowed to pay for new and used vehicles climbed to an all-time high of $968 billion in the third quarter, according to new data from Experian, which tracks auto loans.

"We're seeing record auto sales and vehicle prices are up, so loans are increasing," said Melinda Zabritski, senior director of automotive finance with Experian. "Also, more people are paying for their vehicle with an auto loan as opposed to financing it with a home equity loan or paying cash."

Through October, new vehicle sales in the U.S. were up 5.8 percent, according to the research firm Autodata. If sales stay at that pace during the final two months of the year, the U.S. will set a record for annual sales with an expected total of 17.46 million vehicles.

According to Experian, 61.3 percent of the money borrowed during the third quarter was done so by drivers with prime or superprime credit ratings, who have some of the best track records for repaying their debts.

By comparison, 19.3 percent of the loans were taken out by those with subprime and deep subprime ratings, who have some of the worst credit records.

Experian said the number of loans issued to those with shaky credit has gradually increased since the same time period in 2011, when the percentage of money borrowed by subprime and deep subprime credit was 18.1 percent.

Still, there is no shortage of people who are suggesting America's red-hot auto market is being fueled by a bubble in subprime auto loans.

Zabritski disagrees.

"I don't see a bubble in subprime loans," she said. "This is a very steady market in terms of loans to high-risk borrowers."

Zabritski pointed out that the percentage of borrowers who have fallen behind on their auto loans remains at a very low rate. In fact, Experian said 30-day and 60-day delinquency rates both dropped in the third quarter compared to one year ago.

Questions? Comments? BehindTheWheel@cnbc.com