Gold rose to a three-month high in volatile trade on Friday, as a mixed U.S. jobs report prompted investors to reassess the outlook for U.S. interest rates this year, putting bullion on track for its strongest weekly performance in more than a year.

U.S. employment gains slowed more than expected in January as the boost to hiring from unseasonably mild weather faded, but rising wages and an unemployment rate at an eight-year low suggested the labor market recovery remains firm.

"The futures curve is showing that the probability of a March (rate) hike has fallen to around 10 percent, around the lowest levels last seen in October, but there is a greater than 50 percent probability there will be an additional hike this year," said Suki Cooper, precious metals analyst for Standard Chartered Bank in New York.

"This has buoyed the risk-off sentiment that has boosted gold prices."

Spot gold was up 0.7 percent at $1,163.50 an ounce, while U.S. gold for April delivery settled up 20 cents at $1,157.70 an ounce.

"The data shows a March (interest rate) increase is not totally out of the question, it's probably 50-50," said Robin Bhar, an analyst at Societe Generale. "That's why gold sold off after the report, as the dollar rose."

As a non-interest bearing asset, dollar-denominated gold becomes less attractive if U.S. interest rates rise.

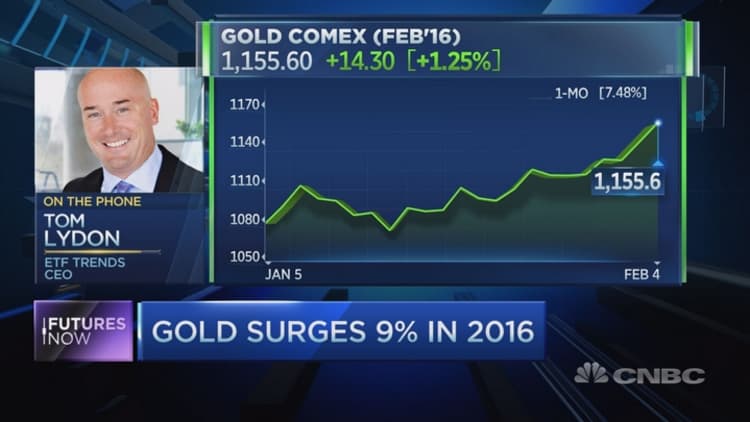

A shaky global economy has lifted buying interest in gold, making it among the best performing assets since the start of 2016 with a gain of nearly 10 percent.

Holdings of SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, rose to 22.3 million ounces on Thursday, the highest since late October.

Other precious metals were unable to turn around from earlier weakness, having fallen from multi-month highs.

Spot silver was up 0.7 percent at $14.97 an ounce, still near Thursday's three-month high of $14.91 and has gained 4 percent this week.

Platinum was down 0.03 percent at $907.50 an ounce, not far below a three-month peak, while palladium declined 2.2 percent to $500.92.