President Barack Obama sent his more than $4 trillion budget for fiscal 2017 to Congress on Tuesday. It's the last budget Obama will deliver as president, and is likely to be contentious as he tries to shore up a two-term legacy and congressional Republicans vie to create gridlock going into the November elections.

We're sure to hear the same talk about spending on small business and the importance of national security, but why not live a little and buy some businesses? We thought we'd help out and make some suggestions for the president, who must be getting tired of making budgetary decisions after seven years in office.

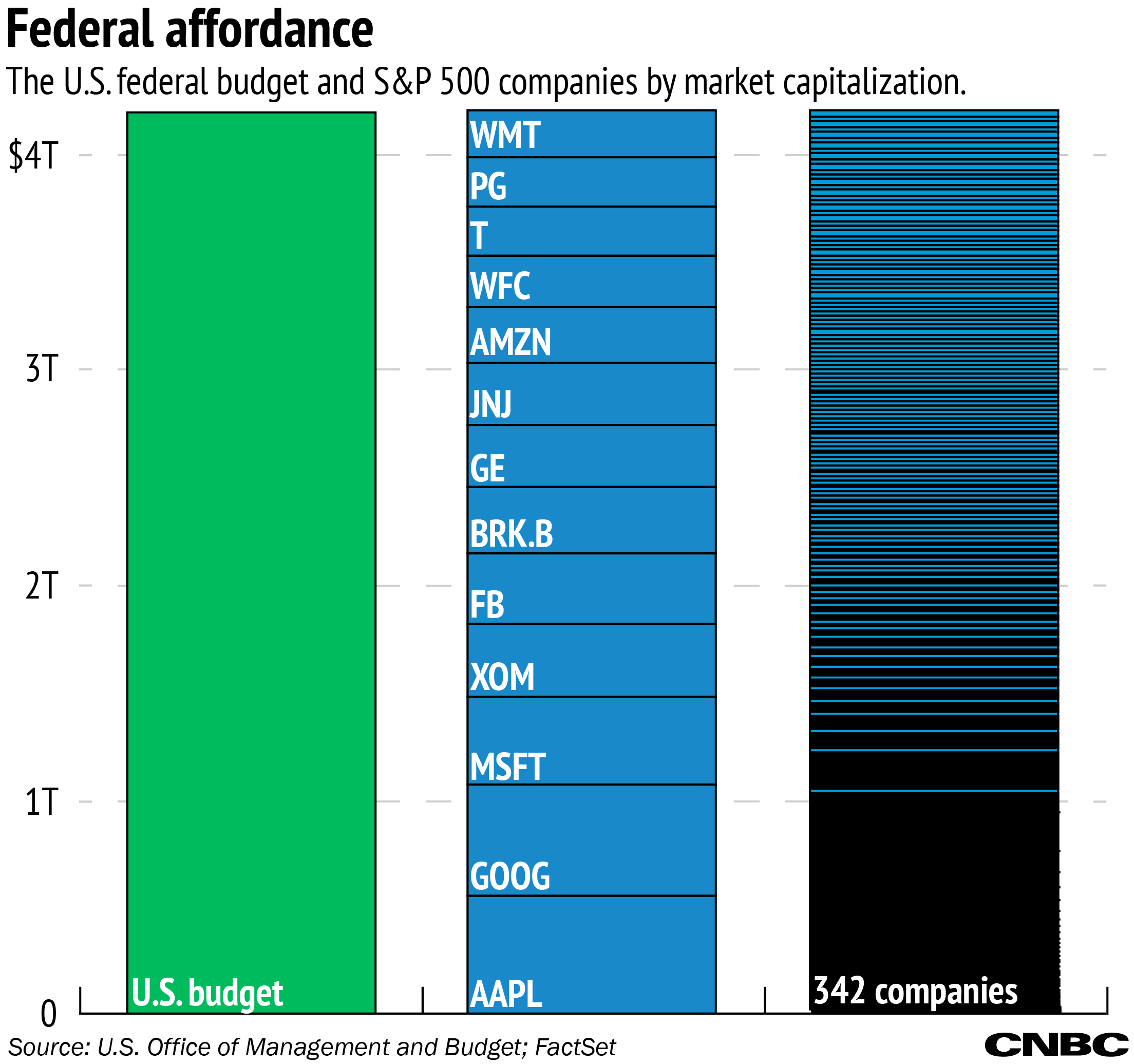

At $4.1 trillion, the U.S. has the largest federal budget in the world in terms of expenditures

If the government wanted to buy companies instead of pay for all the departments and agencies it currently supports, it could acquire more than half of the S&P 500. The $4.1 trillion budget could buy the 342 smallest companies by market capitalization. That includes brands like Kellogg, Pepco Holdings and Sysco.

If it were interested only in the big boys, it could buy the top 13 companies of the index: Apple through Wal-Mart.