Wall Street forgot about takeovers and what those deals can mean for stocks. It forgot how desperate some companies are to grow. It finally remembered on Wednesday, Jim Cramer says, when M&A framed the entire market's action and gave biotech its the best day since 2009.

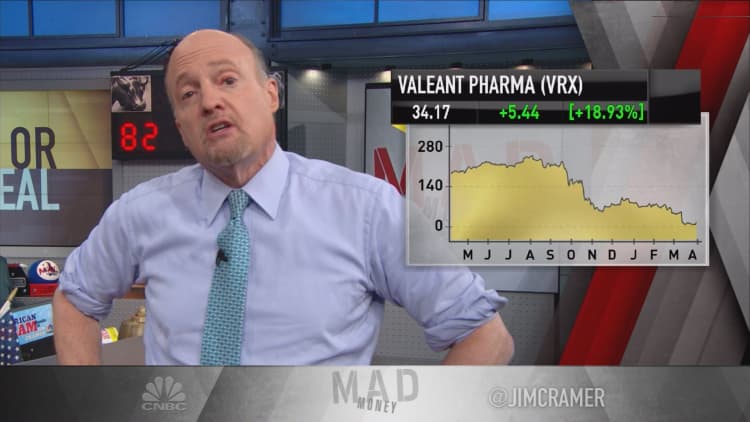

Since February lows, only a select group of stocks have managed to bounce back. However, in the wake of stocks left behind, health care has been in the doldrums. Cramer attributed this to the fact that they are easy political whipping boys in primary season and have had some disappointing earnings.

Allergan CEO Brent Saunders reminded investors of the importance of these deals, when, after confirming the departure from its deal with Pfizer, he told CNBC's "Squawk on the Street" that he was ready to do more buying, stating "Anything that is a growth-oriented business with strong fundamental businesses and a good R&D pipeline to sustain that growth is of interest to us."

Cramer interpreted this as meaning that in short, Saunders will buy anything that can give Allergan growth.

With those words, after months of lagging behind, pharma and biotech stocks were sparked back to life.

Who ever said that the Obama administration is bad for the stock market?Jim Cramer

"You augment that with oil going crazy to the upside, the obsession with oil going higher being fundamental to the bulls in this stock market, and it is like a whole different world out there," the "Mad Money" host said.

In fact, Cramer officially called the new tax inversion rule set forth by the Treasury the "Jack Lew drug bull market" rule. The new rule put both Pfizer and Allergan back on the prowl for a new round of mergers and acquisitions.

Read more from Mad Money with Jim Cramer

Cramer Remix: How to win if oil goes lower

Cramer: Is the government's power worrisome?

Cramer: Hope for biotech in the blast zone

Adding even more irony to the situation, the Justice Department decided to file a suit to block the Baker Hughes-Halliburton merger, which sent those stocks higher on the prospect that they can start acquiring down-and-out companies in the sector.

Cramer has been saying for months that drug stocks alone can't make the market roar; we needed oil, too. And voila! Both were delivered Wednesday.

"Who ever said that the Obama administration is bad for the stock market?" Cramer said.

Many naysayers could speculate that Cramer is condoning froth, he considers it only an observation that two beaten down groups came back to life because the government put a spur under them.

"I say the bulls owe a note of thanks to Treasury and Justice for getting the animal spirits going again and helping to create some wealth in the stock market, even if they clearly only did it by accident. A win is a win," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com

CORRECTION: Biotech logged its best day since 2009 on Wed., April 6. That was misstated in an earlier version of this article.