Wall Street has reason to celebrate this week as U.S. equities have reached a major bull market milestone.

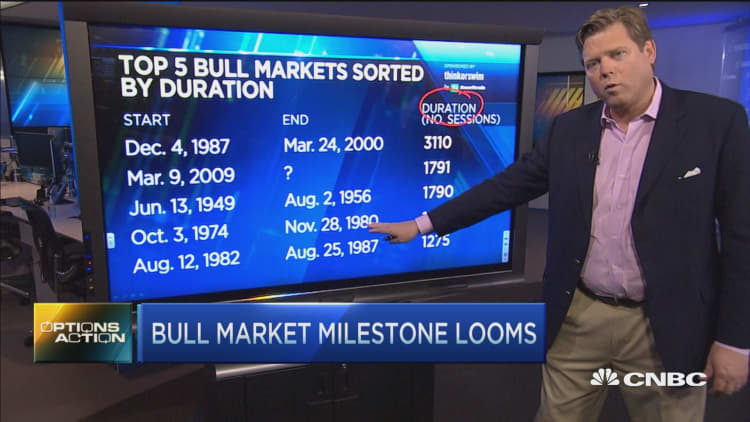

Since March 9, 2009, the S&P 500 has gone more than 1,790 sessions without a decline of 20 percent or more, officially making it the second-longest bull market in history — behind the more than 3,100 session stretch from Dec. 4, 1987, through March 24, 2000, according to Cornerstone Macro's Carter Worth.

Since the beginning of the current run, the large-cap index has surged more than 200 percent, but the rise hasn't come without a few bumps. In August 2011, the S&P fell more than 16 percent to its low in October 2011. There was a more than 9 percent retreat in the markets from September 2014 to October 2015. Since bouncing off those, lows the market has barely budged, trading in a tight and meager range. Of course, more recently, the market has suffered two meaningful corrections, but still has yet to fall victim to what's loosely defined as a bear market — a 20 percent drop from its most recent high.

In that time, the world has been confronted by an unprecedented outbreak of Ebola, a sovereign debt crisis in Europe, a collapse in oil prices and slowing growth in China.

Despite the seemingly unstoppable rally, Worth, who has been calling the end to the bull market for some time, is sounding the alarm.

"By conventional measures because we didn't go down 20 percent the argument is still a bull market, but that's not our view," Worth told CNBC's "Options Action" on Friday. The S&P 500 has barely budged in the last 18 months.

"If you were to look at the lows — despite this happy ricochet over the last nine weeks — in January and February 50 percent of all stocks in the Russell 3000 were down more than 30 percent," said Worth, Cornerstone Macro's head of technical analysis. He pointed out that the Russell 3000 makes up 98 percent of the investment capital in the United States. As of Monday, 49 percent of the index was trading in bear market territory..

"We've been damaged for a long time, and the ricochet doesn't help things," he said. "The big stocks are starting to struggle — Starbucks, Nike — this is the problem."