Stock in candy company Tootsie Roll Industries rose nearly 13 percent in the week following the sudden death of CEO Melvin Gordon last year.

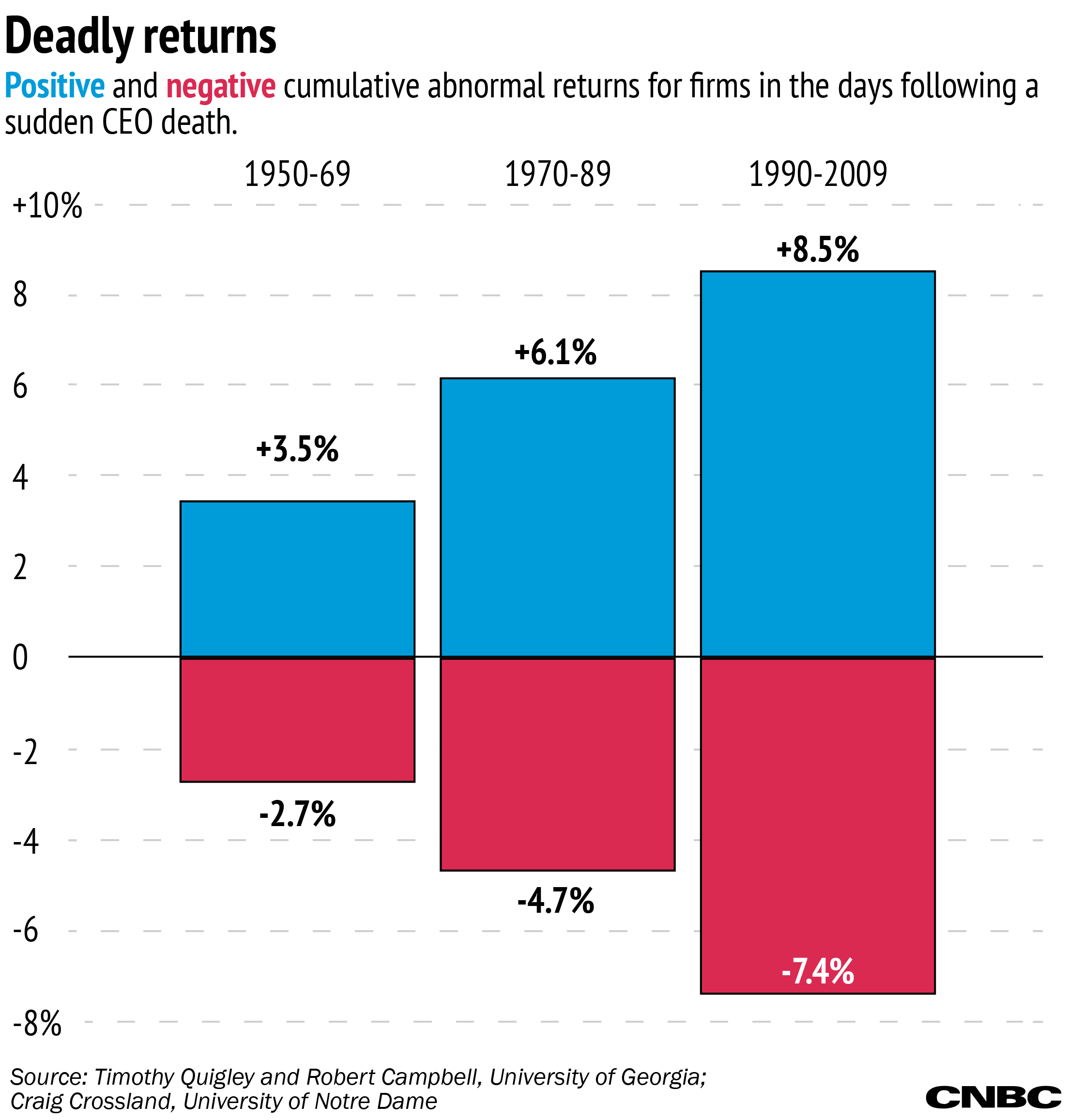

That's not unusual. Since the 1950s, almost half the time a CEO dies unexpectedly, investors react by pushing the stock up. From 1990 to 2009, reaction following CEO deaths brought nearly 9 percent in average unusual returns. That's according to researchers from the University of Notre Dame and the University of Georgia.

Their paper was just published in the Strategic Management Journal and cited in a report by Quartz.

It looks like investors looking to make a quick — if slightly morbid — buck could benefit by going long on hearse-driven stocks. For corporate boards, the research shows that developing a clear succession plan is increasingly important.