Billionaire investor Warren Buffett told CNBC on Monday just how important interest rates are to stock investing.

"If the government absolutely said interest rates are going to be zero for 50 years, the Dow would be at 100,000," Buffett told "Squawk Box," stressing he was speaking hypothetically. The Dow Jones industrial average closed at 17,773 on Friday.

In a CNBC interview last week, Buffett also spoke about interest rates. "If you had zero interest rates and you knew you were going to have them forever, stocks should sell at, you know, 100 times earnings or 200 times earnings," he said.

Consider this: Near zero percent rates from December 2008 to mid-December last year helped pushed the Dow up more than 100 percent. That happened as Wall Street was waiting for the penny to drop on a hike, which finally happened Dec. 15, 2015.

If zero rates were a certainty for 50 years, Buffett was basically saying stocks could make a move exponentially higher, when considering how far the Dow came in just seven years.

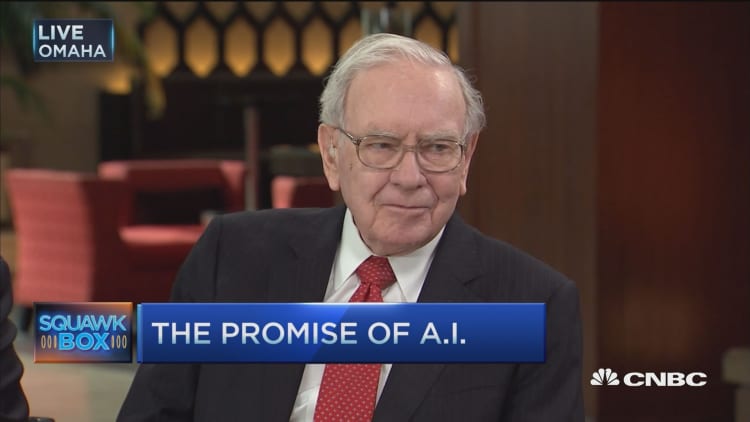

The chairman and CEO of Berkshire Hathaway was interviewed in Omaha, Nebraska, where he hosted the annual meeting of the company's shareholders on Saturday.