Jim Cramer was intrigued when Micron Technology suddenly got its groove back on Thursday.

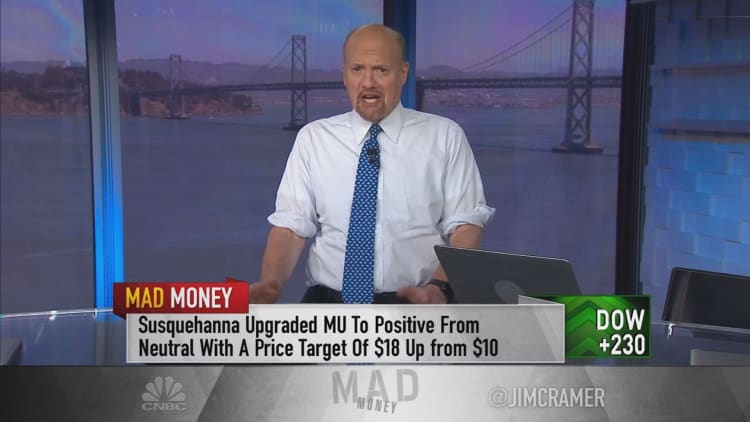

Micron jumped a monster 10 percent after it was upgraded by both Susquehanna and Nomura. And the good news is that Cramer thinks this isn't just the stock playing catch up. This could be the beginning of something good.

"It looks to me like a major turn could be unfolding, with not one but several product lines doing better," the "Mad Money" host said.

Micron's two main products are within the scope of dynamic random-access memory (DRAM) and flash memory. After a 50 percent decline in pricing in the past two years, DRAMs are finally going higher.

Now inventories have been worked off, and you could get a radical upswing in pricing.Jim Cramer

Initially the decline in DRAM pricing occurred after consolidation in the industry was supposed to drive prices higher. However, the secular decline of PC usage impacted pricing so much that the consolidations didn't matter.

"Now inventories have been worked off, and you could get a radical upswing in pricing that would give Micron much higher earnings," Cramer said.

This would explain why Susquehanna increased its price target to $18 from $10. Cramer loved Nomura's position on the upgrade, as it recommended a barbell strategy of buying the highest growth companies such as Applied Materials, Broadcom, NVIDIA, Texas Instruments and Micron.

For investors that believe in this barbell strategy, Cramer also recommended Western Digital and NXP Semiconductors. He considered NXP to be more of a play on the internet of things, as it is linked more to the car than the PC.

"However, when Micron and Western Digital catch a bottom in pricing, that's not going to go away in 90 days. That's why I think both stocks are buys for a least another 10 percent," Cramer said.

So, while Cramer warned not to get too carried away with these trades, he does think there is something interesting happening. When two firms recommend Micron, that's worth paying attention to.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com