President Donald Trump is delaying a rule requiring your financial advisor to provide you with advice that's in your best interest.

Trump signed a measure Friday ordering a Labor Department review of the fiduciary rule. The move will likely lead to a postponement of the regulation's implementation on April 10, 2017.

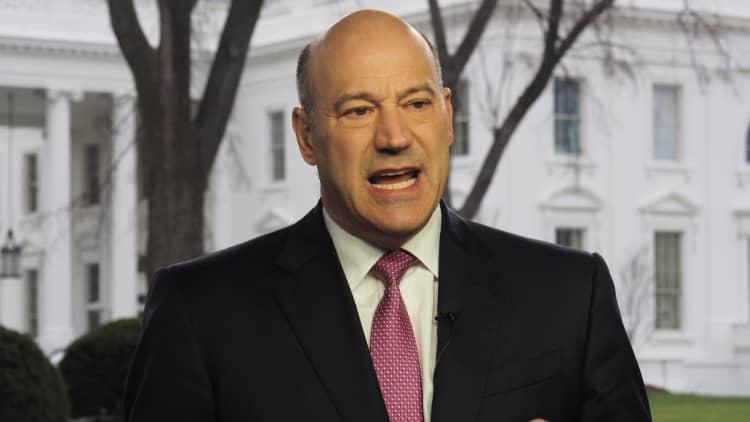

"They thought they were trying to protect investors in their retirement accounts, but by protecting investors they highly limited their choices," Gary Cohn, director of the National Economic Council, told CNBC Friday morning on "Squawk on the Street."

"I don't think you protect investors by limiting choices," he said.

The regulation covers individual retirement accounts, as well as rollovers out of company-sponsored 401(k) plans.

A 2015 report from the White House Council of Economic Advisers estimated that conflicts of interest by brokers, on average, reduce annual returns on retirement savings by 1 percentage point and cost investors up to $17 billion a year.

The president's action "will probably lead to a delay at least," Skip Schweiss, president of TD Ameritrade Trust Co., said today at TD Ameritrade's National Linc conference in San Diego.

Edward Mills, a financial policy analyst at FBR Capital Markets, said in a note Friday that the firm expected a further delay of the fiduciary rule — as long as two years — once Trump's new Labor secretary is sworn in.

Legal challenges

The department first introduced the regulation in 2010.

Since then, organizations representing the financial services industry have fought its progress, resorting to a volley of lawsuits against the federal agency.

This includes cases filed by the National Association for Fixed Annuities, as well as the U.S. Chamber of Commerce and the Securities Industry and Financial Markets Association.

The rule also has faced challenges from legislators. Rep. Joe Wilson (R-S.C.) introduced a bill on Jan. 6 that would delay the regulation for two years.

Financial services industry responds

A number of banks and broker-dealers have changed their compensation practices to comply with the fiduciary rule to curtail conflicts of interest.

For instance, last year, Merrill Lynch announced it would stop offering new commission-based IRA brokerage accounts through its advisors.

Instead, it would give customers three choices for retirement-related investment advice: They can work with an advisor on a fee-basis, paying a percentage of assets invested. They can also use commission-based, self-directed brokerage accounts, or Merrill Edge Guided Investing, a fee-based robo-advisor option.

We can still anticipate lawsuits without the rule.Marcia S. Wagnermanaging director, The Wagner Law Group

Legal experts predict such trends may continue.

"You'll see the restructuring of compensation at the wire house level, the broker-dealer level and the financial advisor level," said Marcia S. Wagner, managing director of the Wagner Law Group in Boston.

Expect the courts to be busy with investors suing their advisors and firms, she said. There has already been a spate of lawsuits in the 401(k) world, alleging fiduciary breaches and excessive fees.

"A giant has been awoken and the tort bar realizes there are lots of issues in the retirement industry and that won't be going away," Wagner said. "We can still anticipate lawsuits even without the rule."

Lower fund costs

Others believe that investors' move toward low-cost indexed-based investing will keep up.

"CFRA expects continued adoption of low-cost index-based ETFs and mutual funds to persist even if the DOL rule is halted or delayed," wrote Todd Rosenbluth, senior director of ETF and mutual fund research at the New York-based equity research firm, in a note on Friday.

"In the last few years, many advisors have voluntarily shifted to a fee-based business over commissions and many brokers are encouraging this trend," he wrote. "Expensive and underperforming funds are harder to justify inside client portfolios."

What you can do

Without the regulation in place, investors will have to be even more watchful on their own, consumer advocates said.

Some $7 trillion in IRA assets are at the center of the fiduciary debate. They are large moneymakers for financial services firms and would be subject to the rule.

To protect yourself, get to know how your advisor is paid. Is he or she paid a commission for the sale of mutual funds, annuities and insurance?

Barbara Roper, director of investor protection at the Consumer Federation of America, recommended asking your advisor to sign a fiduciary oath, which will require him or her to avoid conflicts of interest.

"People have a right to know," said Roper. "We think they have a right to best interest advice and a right to know which firms are working in their best interests and which are working against them."

'Delayed' reaction

Members of the financial services industry cheered Trump's move.

"On behalf of the retirement savers who depend on their financial advisors, we applaud the president's action, which will delay a rule with devastating consequences with so many people," said Dale Brown, president and CEO of the Financial Services Institute, an organization that represents the broker-dealer industry.

A delay of the regulation could give the Labor Department time to go over portions of the rule that are still difficult to put into effect.

"There's still a lot more that we need to know, in terms of more guidance from the DOL, to address the rough edges of the regulation," said Bradford P. Campbell, a partner at Drinker Biddle in Washington, D.C., and a former assistant secretary of labor at the DOL.

Greater risk?

Consumer advocates were concerned the delay would put investors at risk.

"Overwhelming evidence shows even before the rule has been fully implemented, it's bringing down costs for advice and investment products," said Roper of the Consumer Federation of America.

"It's reducing the incentives advisors have to act in ways that aren't in the customers' best interest," she said.

AARP, which represents older Americans and is a supporter of the fiduciary rule, expressed its disapproval of the president's move.

"Today's executive action harms middle-class Americans by pushing back the compliance date," said Nancy LeaMond, AARP's executive vice president, in a statement.

"Unfortunately for many Americans, today's executive order means they will continue to get conflicted financial advice that costs more and reduces what they are able to save in retirement," she said.

(This story has been updated with additional comments throughout.)