The White House is expected to name former OneWest executive Joseph Otting as comptroller of the currency, according to two people with direct knowledge of the selection process, installing a close colleague of Treasury Secretary Steven Mnuchin in a key regulatory role.

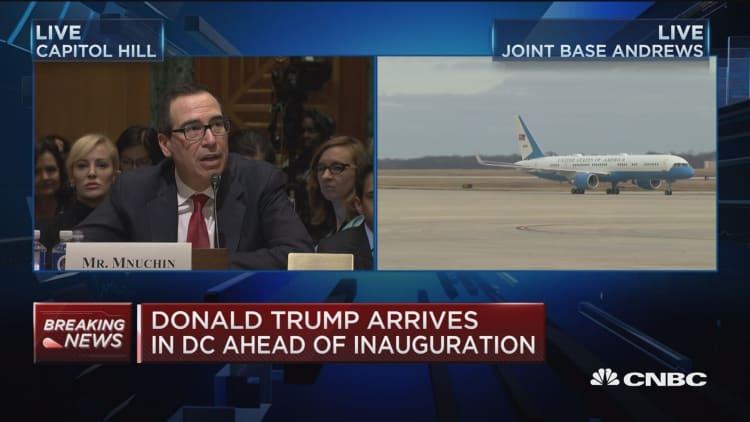

The sources said Otting has undergone formal vetting. One person with direct knowledge said he has received a thumbs-up from Mnuchin, with whom he worked closely at OneWest, the California bank that the Treasury secretary purchased in 2009. Another said Otting has gained the approval of President Donald Trump.

The administration had also looked at Thomas Vartanian to lead the OCC. But now, two people familiar with the process said he is being considered to join the Federal Reserve's board of governors as vice chair of supervision, the central bank's key banking oversight role.

A White House spokeswoman declined to comment on personnel matters. Sources said the timeline for any announcements are uncertain.

The Office of the Comptroller of the Currency is an independent agency within Treasury and is responsible for overseeing the nation's biggest banks, including Bank of America, JPMorgan and Wells Fargo.

The agency is currently led by Thomas Curry, but his term ends next month. His replacement is expected to play a significant role in carrying out Trump's promise to roll back regulations — including doing a "number" on the sweeping law known as Dodd-Frank that was implemented following the 2008 financial crisis.

Otting joined OneWest as chief executive in 2010. At the time, Mnuchin cited Otting's knowledge of the market, client relationships and leadership capabilities. He was a visible defender of the bank during community protests accusing it of aggressively foreclosing on homeowners, and during the bank's merger with CIT. However, Otting was fired after the acquisition.

Before joining OneWest, Otting was vice chairman at U.S. Bank and led its expansion in California. He also served as an executive at Union Bank, where he focused on commercial loans.

A possible new banking cop

Vartanian is a well-known figure in the regulatory world.

His four-decade career has included stints at regulatory agencies and in the private sector representing banks. He advised Bank of America on its purchase of the troubled mortgage lender Countrywide during the financial crisis and has written several books on banking regulation.

Vartanian also has a tie to OneWest: He represented one of the investors in the deal.

Senate confirmation would be required for both Otting and Vartanian to serve in their respective positions.

The connections to Mnuchin's bank could become stumbling blocks during the confirmation process. Democrats have criticized Mnuchin's leadership of the bank, holding hearings with homeowners who were foreclosed upon by OneWest. Still, Mnuchin's nomination was approved 53-47.