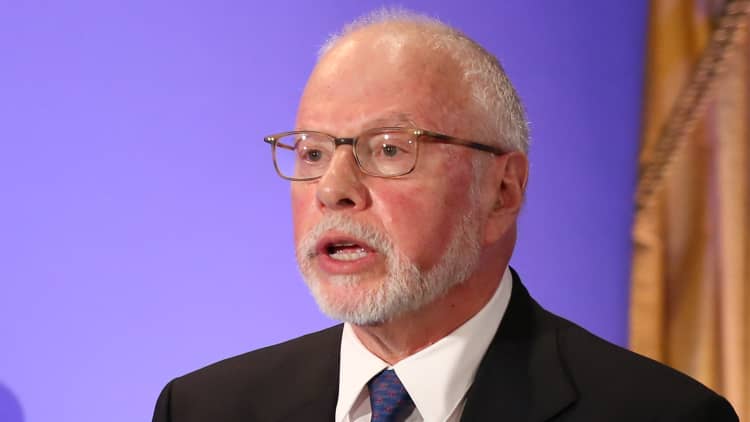

Health-care technology company Athenahealth and its colorful chief executive Jonathan Bush have contended with critics in the past. But now they face their first major activist in Elliott Management – one with a track record for rebooting management and selling companies.

Elliott disclosed a 9.2 percent economic exposure to Athenahealth's common stock on Thursday through ownership of shares and derivatives. Shareholders applauded the investment, sending the stock 22 percent higher in Thursday trading.

Elliott declined to comment beyond the filing, where it said that it believes there are "numerous operational and strategic opportunities to maximize shareholder value. The filing said Elliott would be seeking to discuss its ideas with Athenahealth's board.

In the near term, at least, Elliott and Athenahealth, a maker of electronic patient records software, intend to keep their dialogue private, according to people familiar with the situation. Elliott did not file a public presentation calling for specific changes.

But if the firm's past moves are any indication, Athenahealth could be facing some big potential changes. And based on the huge jump in its share price, other investors are anticipating a big revamp.

Perhaps the most-conservative path forward would be for Elliott to work with management to find ways to improve operations. However, if Elliott finds it cannot work with Athenahealth management, it may seek to unseat them and or explore strategic options, like a sale or buyout.

"Companies like this – good businesses with good products but a somewhat unstable management, are viewed as un-investable by many investors but good opportunities for activists," said Kenneth Squire, chief investment strategist of the 13D Activist Fund in a note today. "There is an excellent opportunity to cut costs and focus on operations with the right management team."

The best way to do that, Squire said, would be to bring in a new management team or sell the company.

Athenahealth's stock has slumped 45 percent from its high in February 2014 and is seen by investors as one of the more-volatile stocks in the sector. Short interest is around 19 percent of the company's float, according to data compiled by FactSet.

David Einhorn of Greenlight Capital has been short Athenahealth as recently as two years ago, where he presented reiterated the idea at the Sohn Investment Conference in 2015. Einhorn took particular aim at the CEO for some of his controversial comments, like when Bush said that the company was trading at 21,000 times earnings but wasn't actually worth that much. A representative of Einhorn declined to comment on whether Einhorn was still short.

Bush could come under fire as the conversations progress. He is known for being outspoken and at times, controversial. And Elliott has taken aim at management in some of its recent investments, recently calling for the ouster of Arconic's Klaus Kleinfeld, who resigned after sending a threatening letter to Singer without board approval. The firm is also headed to court on Monday in the Netherlands to seek means for removing Anthony Burgmans , the chairman of Akzo Nobel, which has rebuffed several takeover offers from Pittsburgh-based PPG Industries. Elliott holds a stake in the Dutch paint maker.

The firm also has a strong track record for helping push companies to be sold. In the last seven years, Elliott has engaged in 38 campaigns, of which 20 have been sold, according to data compiled by Bloomberg, cited by an Evercore analyst.

Elliott is also different from other hedge funds in that it has a private equity arm known as Evergren Coast Capital Corp. The private-equity unit, agreed to purchase Dell's software unit last year with Francisco Partners Management. That gives the firm more flexibility to ultimately buy companies outright if it so chooses.

At the moment, Athenahealth plans to engage with Elliott.

"We are aware of Elliot's filing and look forward to talking with them to hear their views about the Company and discuss the actions we are taking to drive enhanced growth and value creation for all athenahealth shareholders," the company said. "We have great confidence in the Company and where we are headed."

Athenahealth three-year performance

--With reporting by Meg Tirrell and Bertha Coombs