European stocks finished trade sharply higher on Monday, supported by gains in trade seen overseas, as investors worldwide continued to monitor the economic impact of Hurricane Irma.

The pan-European Stoxx 600 ended up 1.04 percent, with all sectors closing in positive territory.

The U.K.'s FTSE 100 rose 0.49 percent by the close, while France's CAC 40 and Germany's DAX, closed up 1.24 and 1.39 percent respectively.

European stocks followed a positive session in Asia and preceded a strong trading session on Wall Street. Around the European close, the Dow Jones industrial average posted gains of more than 200 points.

Insurance sector jumps, while health care's Lundbeck sinks 13.8%

Insurance stocks led the gains on Monday, closing up 2.15 percent, after the projected insured loss in the U.S. resulting from Hurricane Irma was cut to between $20 billion and $40 billion by AIR Worldwide forecast.

Among the top gainers in Europe's insurance index were Beazley, Swiss RE and Munich Re, which all finished trade 4 percent or higher. Germany's Hannover Re finished at the top of the benchmark, jumping 5.38 percent.

Looking at the health care sector, Danish pharmaceuticals company, Lundbeck, tumbled to the bottom of the benchmark on Monday. The group's CEO Kare Schultz resigned from his position and opted to join Israeli drug company, Teva. Shares in Lundbeck sank 13.8 percent .

Sticking with the sector, Roche shares slipped 1.27 percent following news of the failure of trials for its skin cancer treatment Zelboraf.

Pharma heavyweight AstraZeneca however reported two of its drugs tackling lung cancer had delivered impressive clinical results on Saturday. Its shares rose 2.08 percent.

Elsewhere, Swedish-based fashion retailer, H&M jumped 2.9 percent, after the group received a rating upgrade from Credit Suisse. The bank upgraded the firm by two notches to "outperform" from "under-perform".

Irma and North Korea fears soften

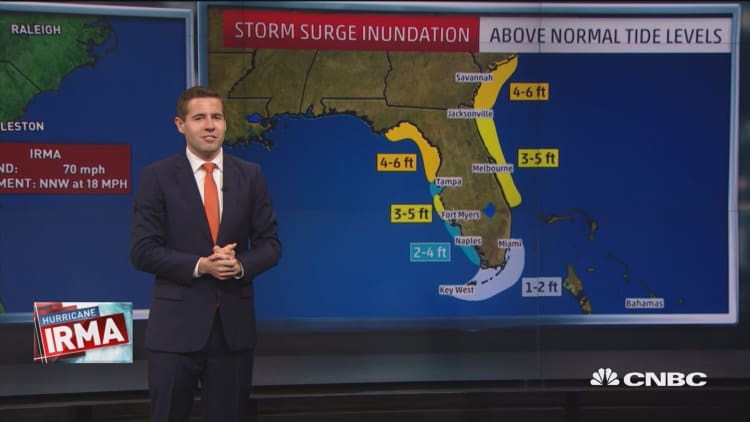

Hurricane Irma weakened to a tropical storm on Monday, according to the latest update from the National Hurricane Center. However Irma is still producing wind gusts which are close to hurricane force and the storm is currently moving its way across Florida.

Hurricanes in the region have added jitters to markets worldwide as of late, as investors show signs of unease when it comes to the impact of natural disasters on certain markets, including insurance, travel and energy.

Speaking of oil, prices fluctuated on Monday, as investors watched the path of Irma closely. At 4.30 p.m. London time, Brent traded down at $53.49 per barrel, while U.S. crude wobbled but edged higher, hovering at $47.70.

Elsewhere in commodities, spot gold and silver prices fell into the red on Monday, as safe havens lost their attraction and the U.S. dollar bounced back. Investors showed signs of relief on Monday, after North Korea chose to not launch another missile over the weekend, although the country did warn that the U.S. would pay a "due price" for spearheading a U.N. resolution against the country's recent nuclear test. This according to Reuters.

Consequently, the metals sell-off caused precious metals firms like Randgold Resources and Fresnillo to stumble in trade.