It's a comparison no one wants to hear — that this stock market bears striking similarities to that of 1929.

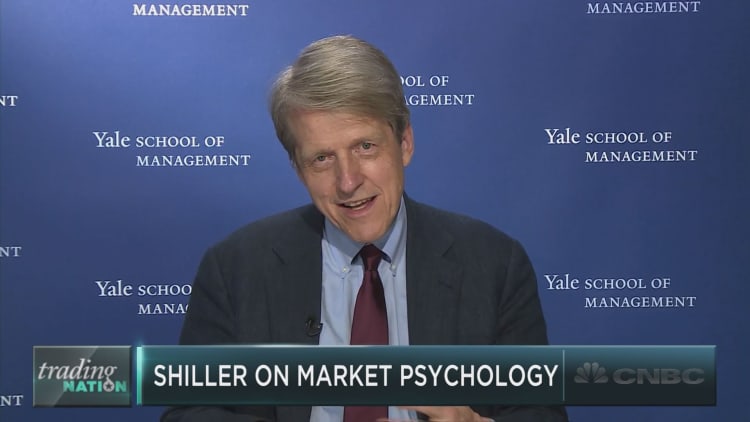

The observation is coming from Nobel Prize-winning economist Robert Shiller, who's been arguing valuations are extremely expensive.

But instead of predicting an epic stock market crash, he's finding reasons to be optimistic.

"The market is about as highly priced as it was in 1929," said Shiller on Tuesday's "Trading Nation." "In 1929 from the peak to the bottom, it was 80 percent down. And the market really wasn't much higher than it is now in terms of my CAPE [cyclically adjusted price-to-earnings] ratio. So, you give pause when you notice that."

In his first interview since penning an op-ed on Sept. 15 in The New York Times, the Yale University economics professor reiterated to CNBC that there's one vital characteristic protecting investors from losing their nest eggs: Market psychology.

"It's not just a matter of low interest rates, it's something about the American atmosphere. It's partly the Trump atmosphere. Investors love this. I can't exactly explain – maybe it has something to do with prospective tax cuts. But I don't think it's just that. It's something deeper, and it's pushing the American market up," he added.

Unlike 1929, Shiller points out there's not much talk about people borrowing exorbitant amounts of money to buy stocks. Plus, he notes there's now more regulation.

But don't mistake the Yale University economics professor for a bull.

"I don't want to encourage people too much to put a lot into the most expensive market in the world," said Shiller. "The U.S. has the highest CAPE ratio of 26 countries. We are number one."

Shiller's latest thoughts came as stocks extended a record win streak.

The Dow hit both an all-time intraday high and close. It's now up 22 percent since Donald Trump won last November's presidential election.

The and Nasdaq both closed at fresh record highs on Tuesday, too.

Shiller may see red flags, but he isn't ruling out a market that continues to churn out fresh records for months, if not years.

"I wouldn't call it healthy, I'd call it obese. But you know, some of these obese people live to be 100 years, so you never know," said Shiller.