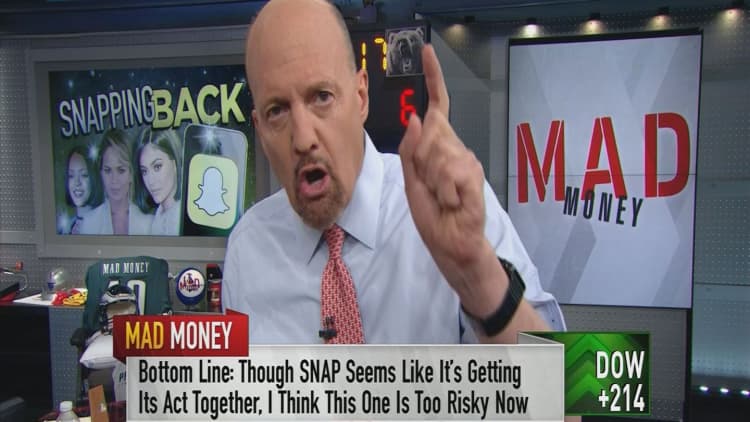

CNBC's Jim Cramer cautioned investors against buying Snap despite the social media company's new app redesign — at least for now.

"The stock is not cheap here," Cramer said on "Mad Money" Tuesday. "I say take a pass — for now — at least until we know whether the Snapchat redesign will actually hurt them. I think it's a little bit too risky. I'd prefer to see more panic, more sturm und drang."

Snap, the parent company of Snapchat, was founded in 2011 and went public in March 2017. Shares maintained the initial IPO trading price at the time of the first earnings report, but plunged more than 60 percent by summer, falling from their March 3, 2017's highs of $29.44 to $11.28 a share on August 14.

The main problem, Cramer said, is that Snap isn't growing fast enough and its expenses are too high. The company reported a loss of $2.2 billion during the first quarter of 2017.

"These guys were spending money like a boatload of drunken sailors," Cramer said.

But Snap made gains in the third quarter of 2017, attracting the attention of some investors and garnering some analyst upgrades.

However, the app redesign, launched in December 2017, became the source of much controversy.

During the third-quarter conference call, Snap co-founder and CEO Evan Spiegel said the app's redesign was intended to make the platform more user-friendly. He added that while the redesign might affect earnings in the short term, the pain was only temporary.

The formula seemed to work. Amid increased volatility and the first major market correction in two years, Snap shares rallied 47.6 percent on February 7, climbing from $14 a share to more than $20 a share. In the same month, Snap beat earnings expectations for the quarter, reduced spending, had higher-than-expected monthly average users and higher-than-average revenue per user.

But Cramer still wasn't convinced.

"Every time the stock tries to make a comeback, like it did a few months ago, something seems to go wrong," he said on Tuesday.

In less than three months, the company erased all of its gains from the Feb. 7 rally.

Cramer said the app's redesign is the primary culprit. The new interface mixes up private messages with users' stories, whereas the previous version was two separate feeds.

"The reviews of the new app were terrible," Cramer said. "It seems like it's designed to alienate the very celebrities who use Snapchat to connect with their fans."

The problems with the redesign were obvious to many, Cramer said, and pointed out that more than a million people signed a petition at Change.org asking the company to rollback the redesign. Citigroup downgraded the app to "sell" on February 20 in response to the negative reviews. In addition, reality star Kylie Jenner took to Twitter to announce her displeasure with the new app.

The company came under fire again in March 2018 when musician Rihanna criticized Snap for allegedly shaming domestic violence victims. Shares fell 10 percent over the next four days.

The company's business model depends on advertisers, who Cramer fears could "leave in droves" if user engagement declines.

"Snap needs users to sell ads, and if the new design is driving people away, that's going to hurt the numbers," Cramer said.

The final blow came in March when the company laid off 7 percent of its global workforce, mostly engineers and salespeople.

"The market took the move as a company born under a bad sign," Cramer said.

Meanwhile, Barclays published a note last week defending the stock and saying the redesign worries were overblown.

"I'm actually sympathetic to the bull thesis down here given how hated the stock's become," Cramer said. "I would like it to go to a little lower level. The stock's trading at nine times next year's sales estimates. That's what makes me a little bit perturbed, because that's way too expensive for a name, for a stock that is so controversial."

Still, Cramer conceded, if the company can get its act together, then maybe, "at a certain price, it is time to hit the buy button."

WATCH: Cramer doubles down on his Snap critiques

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com