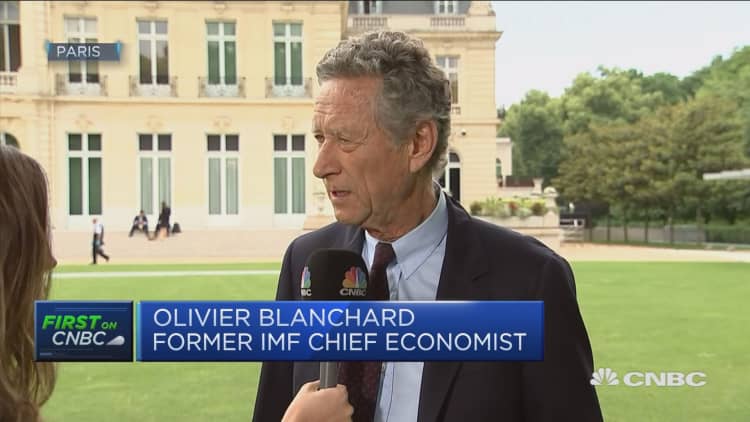

Political chaos in the euro zone's third-biggest economy won't be going away anytime soon, according to International Monetary Fund former chief economist Olivier Blanchard, who on Tuesday issued an ominous assessment of the country.

Panic roiled markets Tuesday as a political fight in Italy prompted one of its worst market sell-offs in years. Underlying investor fear was the prospect of Italy leaving the euro and others following suit, which Blanchard, now an economics professor at the Massachusetts Institute of Technology, described as more of a psychological fear than a realistic threat.

The potential concern, rather, involves Italy's creditors, who would have to "move carefully," the economist told CNBC's Joumanna Bercetche in Paris. The rest of Europe may avoid a domino effect, but Italy looks to remain mired in a quagmire.

"I suspect in this case the EU will do whatever is needed to prevent contagion, so I'm not terribly worried about contagion," Blanchard said. "I'm very worried about Italy. Not worried about the rest of Europe. It will be tough, but the rest of Europe, the rest of (the) euro will be OK."

President thwarts winning parties

The winners of Italy's last elections — the populist Five Star Movement (M5S) and the far-right Lega party — made Paolo Savona their pick for economy minister. His euroskeptic views match the parties' anti-establishment agenda.

The trigger for the sell-off took place over the weekend when Italian President Sergio Mattarella rejected Savona, effectively thwarting the winning parties' ability to form a government.

Mattarella's veto threw Italian politics into chaos and have mandated fresh elections to take place as early as July. Meanwhile, former IMF official Carlo Cottarelli has been appointed to oversee a temporary caretaker government until the new elections are held.

'The writing was on the wall'

While analysts believe a departure from the single currency is unlikely, a continent-wide confidence crisis hit the euro hard, putting the shared currency down 0.7 percent to $1.1540 against the dollar. Italian bonds suffered their ugliest day since 1992, with the yield on the 2-year bond spiking by 150 basis points to a brief day high of 2.73 percent.

The country's benchmark stock index was down 2.3 percent Tuesday amid an across-the-board fall in stock markets across Europe and the United States, where the Dow plummeted intraday by more than 460 points before finishing the session 391 points lower.

"The writing was on the wall," Blanchard said. "When you have capital mobility, and you give signals that you might not stay in the euro ... then you expect investors to move, and I think that's what we are seeing."

Markets were already nervous about M5S and Lega's economic plans for Italy. Though the parties did not in fact pledge to leave the euro, they signaled a disregard for the EU's fiscal rules, such as those limiting states' deficit levels. The parties' leaders have pitched plans to cut taxes, boost public spending and introduce guaranteed basic income, among other costly proposals.

Threatening European growth

Italy has the highest debt in the euro zone, which at 132 percent of GDP is twice that of Germany's and far above the euro zone's 87 percent. It also has a raft of bad loans in its banking sector.

Asked if there may be positives to the standoff in the form of EU concessions for Italy in order to prevent a pull-out, Blanchard responded, "No. I am not optimistic."

Unsurprisingly, he described himself as very bearish on the country.

The best-case scenario, the economist said, would be for the winners of the next elections to provide a program that satisfies the voter base — victory is predicted for the populist parties again — but remains fiscally responsible.