“I think the brand equity that Apple carries right now alone is enough to make the iPhone successful,” says Andy Hargreaves, an analyst at Pacific Crest Securities, who owns Apple shares. “I don’t know if it will reach 10 million units by next year as Steve Jobs would like, but we think it will be a success, and we think that the company is not only expanding the market for smartphones, but also changing the argument from purely technical specs to one of fashion and panache.”

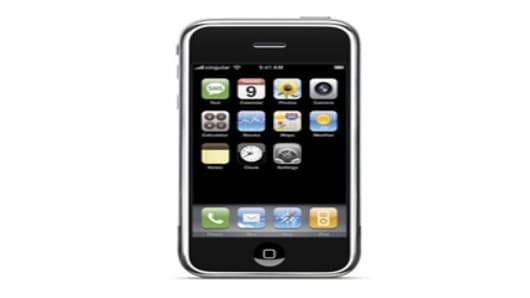

The design of the iPhone is expected to up the ante for cell phones as fashion accessories. In addition, it is expected to tackle perhaps the biggest issue facing the latest generation of mobile phones: How does one make smartphones that are less confusing and cumbersome even as these devices become crammed with multimedia capability to allow users to play music, watch video, take photos, send email, and surf the Web.

“I think it is a very significant event for the industry,” says Michael Abramsky, an analyst at RBC Capital Markets. He expects the introduction of the iPhone to have lasting effects on the cell phone industry as it spawns competitive technology.

The early consensus is Research in Motion, with its focus on the business user, could be best positioned to withstand the challenge. Meanwhile, Palm may have a tougher time out-muscling its larger rivals.

At the recent CTIA wireless technology conference in Orlando, Fla., AT&T Chief Operating Officer Randall Stephenson said the phone giant's Cingular Wireless unit has already received more than one million inquiries about the iPhone on its Web site.

How this interest will translate into sales is still an unknown factor. Cingular is not taking any advance orders on the phone, which will begin shipping in June.

The iPhone has a high-end price tag: the version with 4 gigabytes of flash memory will cost $499, while the 8-gigabyte version will cost $599.

Although price will play a role in Apple’s success, the reviews also will be important. Analysts are eager to see if consumers believe the iPhone’s touch screen makes the product easier to use, and if consumers are happy with the device’s battery life.

Delayed Purchases

The anticipation does appear to have prompted some consumers to delay their smartphone purchases, says Deutsche Bank analyst Jonathan Goldberg.

“We are a little cautious about the sector right now,” Goldberg says. The analyst, who doesn’t own shares of the stocks he covers, favors companies such as Qualcomm and SirfTechnology Holdings, which supply components to the cell phone makers. He expects these suppliers to benefit no matter which phonemaker wins the battle for market share.