Wall Street suffers one of its worst weeks in years. A "credit crunch" makes it harder to sell debt. A few hedge funds go bust, with fears there could be more.

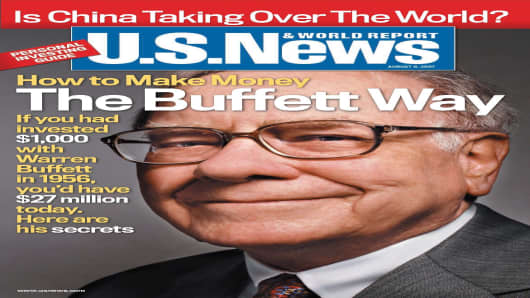

In troubled times, what could be better than a solid dose of "Buffett Basics?" U.S. News and World Reports delivers today, putting Mr. Buffett on its cover with the headline "How to Make Money The Buffett Way." (A spokesperson for the magazine, however, tells me the timing is coincidental.)

Among the collection of articles is "How to Make Money The Buffett Way" and it includes a great distillation of a key lesson that could be especially timely. To quote the piece: "Take advantage of the market's temporary insanity to stock up on sure things at bargain prices."

Let's be clear, however. When writer Alex Markels talks about the "market's temporary insanity" he's referring to a hypothetical situation he poses at the top of piece in which the "bottom" is falling out of the stock market and one particularly good-looking stock drops 15% after missing its earnings expectations by a penny.

The "Buffett Way" certainly isn't to buy big losers indiscriminately in a broad market sell-off and Markels isn't suggesting otherwise. You still need to be careful about what you buy, looking for a company that is "well managed" .. "has a consistent track record of growth" and, ideally, "sells something everyone needs."

In "Six Keys to Investing Buffett Style," writer Paul Lim points out what Buffett's insistence on "quality" in the stocks he buys is an "adjustment" to the teachers of his mentor, the great value investor Benjamin Graham. Graham would be willing to buy any stock as long as it was trading at a discount to its "intrinsic" value, which is determined by looking at real-world things like assets and growth. Given Buffett's great track record, it's hard to argue with his reinterpretation.

What does Lim call the "six keys" to the Buffett style?:

- Make money by not losing money

- Don't get fooled by earnings

- Look to the future

- Stock with companies with wide "moats"

- When you bet, bet big

- Don't be afraid to wait

That last one is very important. Patience is a virtue. Don't buy a stock only because its much cheaper now than it was a few days ago. Make sure there's underlying quality. And remember, that combination of value and quality doesn't come around all that often. Lim puts a key Buffett rule into a baseball context: "Don't swing that often. And don't swing at bad pitches."

Questions? Comments? Email me at buffettwatch@cnbc.com