The 1983 comedy movie 'Trading Places' should be required viewing for those with a taste for investing in commodity markets. Now I've got your attention ...

Orange juice futures, or to go by their official market designation -- Frozen Concentrated Orange Juice (FCOJ) -- take centre stage towards the movie's denouement as the conniving Duke brothers, Mortimer and Randolph, unlawfully obtain an advance copy of an official orange crop report to help them corner the market.

Like the typical Hollywood movie it is, 'Trading Places' takes some artistic liberties. Still, it does have an important message about the brightly colored citrus fruit. This is a commodity that's highly susceptible to the vagaries of what the Mother Nature throws at it.

That's why hurricane season invariably creates parallel storms in the FCOJ pits. The juice really gets squeezed at this time of year as tropical storms and hurricanes rampage across the U.S. Gulf, threatening the orange crops in Florida.

Juicy Weather

But that volatility can create trading opportunities. Former orange juice futures trader Kevin Kerr points out: "Whether it's hurricanes off the coast of Florida or a hard freeze in January, juice can offer some good volatility for the trader looking to cash in." OJ (and I don't mean the disgraced OJ), is a weather-driven market, Kerr says on Dailyreckoning.com. "A hurricane, or even the threat of one, or a hard freeze in central Florida can send this market reeling."

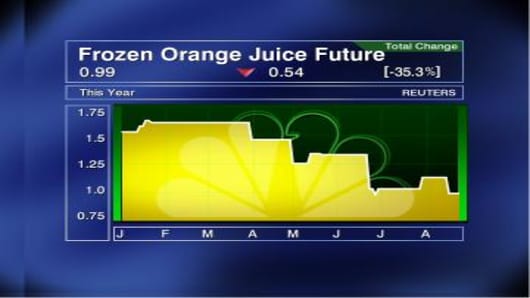

This year, supply is shaping up well despite storm activity. Private forecaster Elizabeth Steger predicts that the Florida 2007/08 citrus harvest will be as high as 200 million (90-pound) boxes. That's well above than market expectations for a crop of as much as 180 million. The bearish above consensus forecast pushed New York Board of Trade's September orange juice futures contract down 9.95 cents to a seven-week low of $1.2175 a pound in mid-August.

Positive news for supply perhaps, but the picture could change dramatically should the weather take a turn for the worse and if the hurricane season takes on a much more violent tone.

The bottom line -- watch those weather forecasts closely. You can be sure commodity traders will be doing the same. Some will even turn into armchair meteorologists as the vagaries of the weather dominate market psychology.

Pour Me That OJ!

Demand-wise, China's consumption for the current market year is looking strong. The U.S. Department of Agriculture forecasts consumption will rise about 18% from last year. That means juicy returns for Brazilian orange growers since the South American producer is China's primary supplier. Brazil also looks well placed to keep up with any additional demand from consumers. Forecasters say the country's orange crop, which accounts for about 80% of the international market, is progressing well with yields in line with projections. The prospect of bumper crops will likely bring more pressure to bear on juice futures in New York that are already off their near 30-year high.

Moving on, it's worth addressing the volatility in global markets and the risk aversion that created. Commodity markets - orange juice included -- haven't been spared the turmoil. A quick glance at the Reuters-Jefferies CRB Index, a basket of 19 commodity futures widely watched by economists and traders, dropped to a six-month low on August 16 before unofficially closing down 3.4% at 301.27.

Investors scrambled for the exits as commodities were swept up in the global rush out of risky investments and into the safety of cash. Analysts are predicting more money to flow out of commodities in the weeks to come. "Hedge funds are sort of gearing up to the expectation that they'll get a lot of redemption notices over the next few weeks and that during the course of September they're going to have to be liquidating positions in order to free up cash to meet those redemption notices," Reuters cited Jeffrey Christian, managing director at commodity research firm CPM Group, as saying.

What this flight tells us is even if a commodity's fundamentals are looking solid, confidence in the broader financial markets, best described as shaky right now, will often dominate investor actions. It may not be just the juice that gets squeezed.

Send Sri your questions and comments at commoditystore@cnbc.com.