However, Paulsen expects that corporate earnings overall could turn out a lot better in the third quarter than many are expecting.

“We’ve had a huge dichotomy of performance,” Paulsen said. He said, the market’s sentiment is based largely on the performance of this one small piece of the economy, but “there are many, many parts of the economy that haven’t been impacted by this crisis.”

“It’s easy to forget, but we had pretty good momentum coming into the quarter,” he said.

One area where he expects to see some earnings surprises is in the industrials and basics segments. Paulsen said he expects these companies may benefit from improvements in trade.

Tech, Health Care To Shine

There also are widespread expectations that the technology and healthcare sectors will turn in strongest performances this earnings season.

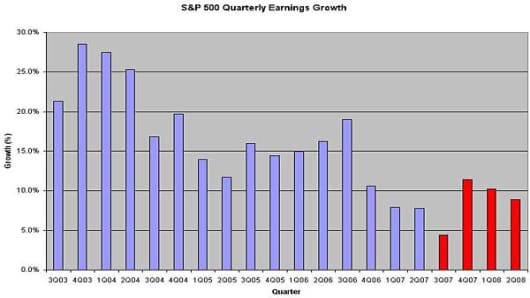

The tech sector is expected to return to double-digit earnings growth in the third quarter, according to S&P's Silverblatt.

“Companies are in a lot better shape than consumers,” Silverblatt said. “They have cash to spend. Much of technology earnings comes from business. They also have international sales.”

According to Andrew Schroepfer, a managing partner at Exponential Capital, the strength in the tech sector is fairly broad.

“You look at Nokia selling record numbers of handsets. You look at Appleselling record numbers of handsets for a brand new device,” Schroepfer said, during an interview on CNBC’s “Squawk Box.” “You can go right down the list…Across the board you see strength.”

On the flip side, the energy and consumer discretionary sectors, which include homebuilders such as KB Homes and automakers such as General Motorsare expected to post weak results.

At the moment, energy earnings are expected to decline, but much of that has to do with the very difficult comparisons energy companies are facing in the year-ago period, when energy earnings rose 34%, according to Silverblatt.

Retailer Warnings

Retailers may disappoint, according to Paulsen. This was certainly the case for Target and Lowe’s, which both warned this week that sales have been soft.

Discount retailer Target trimmed its September sales forecast to a range of 1.5% to 2.5% sales growth, down from a prior range of 4% to 6%.

Meanwhile, home improvement retailer Lowe’s expects the weakness in sales to pressure the company’s earnings estimates for the year. The Mooresville, N.C., now expects earnings for its fiscal year ending Feb. 1 to be at the low end of an earlier forecast of $1.97 to $2.01 a share.

The warnings raised fresh concerns about the health of the consumer, who so far has continued to spend even in the face of rising economic concerns, falling home values, and a turbulent credit market.

No doubt, investors will be looking for fresh clues in the third-quarter results about how Corporate America will fare.

Expectations are high for a strong finish to the year. Still, investors may have already priced in disappointing earnings news since many S&P 500 stocks are trading at a lower price-to-earnings multiple than has historically been the case, according to Silverblatt.

Another wildcard will be the impact of foreign exchange. The record weakness in the dollar likely came too late in the quarter to be a big boost for third-quarter profits, but it could be factor in fourth-quarter outlooks.

Investors need remember that the S&P 500, makes just over half its profits outside the U.S.

Christina Cheddar Berk is a news editor at CNBC. She can be reached at christina.cheddar-berk@nbcuni.com.