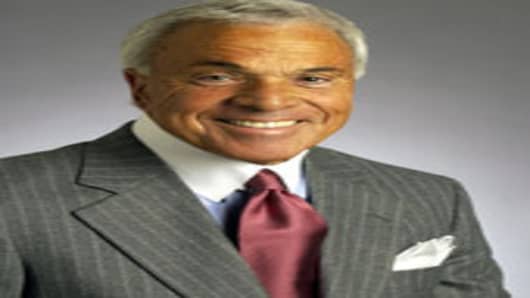

The Securities and Exchange Commission has opened an informal investigation into stock sales by Countrywide Financial’s founder and chief executive officer, Angelo Mozilo, the Wall Street Journal reported, citing people familiar with the matter.

Countrywide is one of a dozen companies the SEC is investigating in connection with the subprime fall-out, the Journal said. At least one area of inquiry involves sales by Mozilo, who sold at least $130.6 million in company stock in the first half of the year through executive sales plans, the Journal said.

A spokesperson for Countrywide said it does not comment on communications with regulators.

An SEC spokesman had no comment. But the agency has previously said it is looking "hard" at the general issue of whether executives are illegally trading on insider information and using a preset trading plan to avoid suspicion.

North Carolina Treasurer Richard Moore has raised questions about the timing of Mozilo's stock sales as problems in the subprime mortgage crisis surfaced. Last week, Moore said he sent a letter to the SEC asking the agency to investigate Mozilo's use of stock options and the timing of changes made to his trading plans.

In an interview with CNBC's Maria Bartiromo in August, Mozilo said he was selling stock because he needed the money for family obligations.