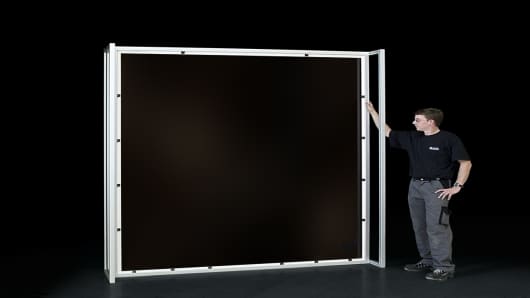

Splinter says his goal is to reduce solar costs from the current $2-$3 per watt to $1 per watt within the next two years and to 70 cents by about 2010, making it a competitive energy source.

Splinter, an engineer and technologist, is also member of the Technology CEO Council and Governors’ Council of the World Economic Forum.

What were the key factors in entering the solar business?

We started to think about core capabilities of our company -- where there are markets and areas to grow. We had looked at a lot of options. One of the options with great opportunity we thought was the energy market, which is very, very large. We had capability no one else had. It certainly was not a mature market. It was open to new players and capabilities.

You’re a technologist among other things. How excited are you about the technological potential?

I think we have the opportunity to set the standard in the market place. It is an exciting opportunity that doesn’t come along very often in the lifetime of the marketplace.

Is this a place where personal philosophy and business opportunities meet?

I certainly have philosophical views on clean energy and steering the company to the energy market. I believe the great social issues of our time are energy and the environment and you have to couple them with solutions that have to be economically viable.

Just how competitive can it be?

Over a period of time, it has to be directly competitive with other forms of energy -- when all the other costs are accounted. Now that it going to take us some time – somewhere between five and ten years, maybe three to seven years.

When it comes to the green movement, is some of it corporate fashion versus a legitimate search for cost-effective alternatives?

I don’t know about fashion so much. It depends on what kind of activity you are talking about. For companies talking about reducing their carbon footprint, it is something that could be taken as corporate fashion but you have to look inside their plans to see what they are about.

What we’re really doing is bringing technology to bear on real problems that face the world for the next 50 years. The environment and energy are two fundamental problems we face. We have to do some serious thinking, create some interesting technology to bring the world forward.