August 2009. Terrorists shut down the Baku-Tblisi-Ceyhan crude pipeline, cutting one million barrels a day. Across the globe, the U.S. threatens Iran with sanctions after an international nuclear watchdog finds a secret uranium enrichment plant. Tehran, joined by Venezuela, responds by axing output by a total of 700,000 barrels a day. Crude prices top $166 and gasoline prices spike over $5.50 a gallon.

Such a cataclysmic scenario sounds like the stuff of Tom Clancy thrillers. It's not. It’s part of an enactment by Securing America's Future Energy (SAFE), a non-partisan group of Fortune-500 chief executives and retired military staff, aimed at waking up policymakers to what President George W. Bush described as America’s addiction to oil. SAFE clearly feel the penny hasn't dropped yet.

A retired military commander and a former Secretary of State played leading roles in the nightmare scenario simulation. The aim was to starkly underscore U.S. dependency on imported oil, particularly from unstable parts of the world, and promote legislation encouraging more energy independence.

"This scenario could happen tomorrow, and we have to talk about dealing with the consequences," said retired Army General John Abizaid, former top U.S. military commander in the Middle East, who played the part of the Chairman of the Joint Chiefs of Staff.

"It may be that it takes a crisis to bring this to the forefront of the political debate," added Richard Armitage, former U.S. Deputy Secretary of State, who played the Secretary of State in the scenario.

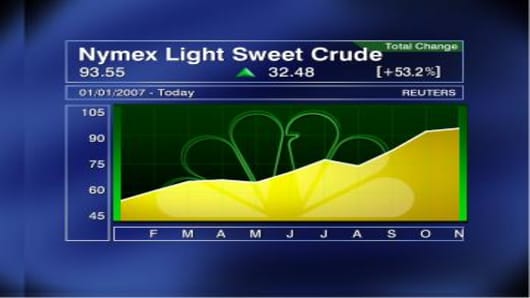

Whether agit-prop or timely wake-up call, the timing of such couldn’t be more critical. At the time of writing, oil prices have pulled back slightly after breaching $96 a barrel, the highest since oil futures started trading in New York back in 1983. Next stop $100?

That’s the talk dominating the market. And the key question is not if, but when, we get there.

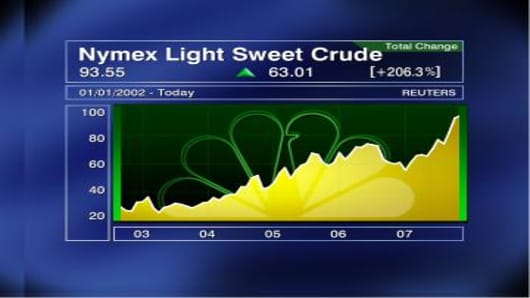

Oil is up almost 60 percent from a year ago and it’s jumped 19 percent in the past month. Given the blistering pace of oil’s appreciation, market watchers are not ruling out a triple-digit oil price by the end of the year, if not earlier.

Speaking to CNBC when oil crossed $86 a barrel back in mid-October, Mark L. Waggoner of Excel Futures, correctly predicted oil would march to $90 and would have enough momentum to reach $100. "We need to see a failure of the market very quickly or these new highs will most certainly hit $90 to $100 on follow-through buying."

Commodity Store

Suddenly, striking a century doesn’t seem to be so far-flung any more. "It's not crazy anymore, it's a reasonable target," said Anthony Nunan, deputy general manager of risk management at Mitsubishi Corp.

As an anecdotal aside, we hear some Wall Street traders have formed a pool betting on what will come first - the Damoclean Sword falling on Citigroup’s embattled CEO Charles Prince or $100 oil.

Discussion of the big one-hundred isn’t a new phenomenon. About two years ago, Goldman Sachs stoked a frenzy of debate after the investment bank said the oil market had entered a multi-year "super-spike" period that would ultimately send crude prices as high as $105 a barrel. At the time "Wall Street gasped, then guffawed" when Goldman made its call, recalled MarketWatch commentator David Callaway: "Oil was averaging around $50 a barrel at the time, well into the Iraqi war, and there was not much reason to see it going any higher then $60, or for the very bullish, $70."

It may not be too long before Goldman is saying, "I told you so."

Even before Goldman’s forecast, former Saudi oil minister Zaki Yamani warned prices could hit $100 if the U.S.-led invasion of Iraq in 2003 triggered retaliation by Saddam Hussein’s forces against oil fields in Kuwait and Saudi Arabia.

And he’s said it again this year. Crude oil would soar above $100 a barrel in the event of a U.S. or Israeli attack against Iran, Yamani said in March. "If America or Israel attacks Iran, and I assume Iran reacts, the price of oil will go to three digits, and you know what this means for the world economy," he said. "It's a very horrible thought."

Will the world be able to cope with oil at $100? That’s a major question the market is grappling with. Though triple-digits will represent a psychological shock (and it’s sobering to remember that prices stood at a mere $9 a barrel just nine years ago in 1998), evidence thus far seems to suggest that the global economy is holding up reasonably well despite elevated oil prices.

Part of the reason seems to be many countries have diversified their energy base away from oil and towards alternative environmentally friendly fuels such as biodiesel. It also helps that alternatives become more economically viable as the price of oil rises. Furthermore, importers like Japan have become more efficient users of energy. The relentless push towards $100 will only galvanize efforts to step up energy efficiency and the development of alternatives.

Jim Glassman of JPMorgan suggests surging oil prices may indeed be a blessing in disguise: "High oil prices, as unhappy as they make us, are doing God's work, by curbing our appetite for carbon fuel, pointing us to greater energy security and limiting the impact of human activity on the environment. The decline in gasoline demand in response to rising energy costs is proof that markets work and that market mechanisms are our best energy policy."

Nevertheless, it’s still early days in terms of oil’s potential slowing effect on the economy and central banks like the U.S. Federal Reserve are no doubt watching oil markets nervously for signs of mounting inflationary pressure.

Two years hence, if this writer is still churning this column, will we be talking about the prospect of $200 a barrel oil? Stay tuned.

Send Sri your questions and comments at commoditystore@cnbc.com.