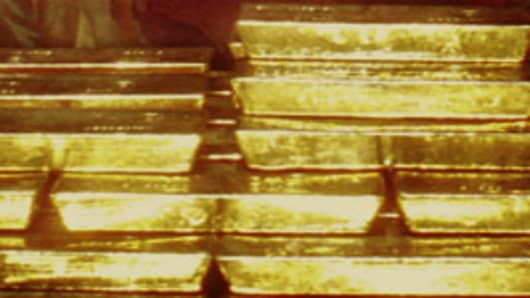

Gold was on track for its biggest yearly gain since 1979, with prices hovering on Monday about $10 an ounce away from its historic highs.

It has jumped more than 30 percent this year as a slide in the dollar, record high oil prices, credit market turmoil, falling U.S. interest rates and geopolitical tension helped to increase its safe-haven appeal.

"For gold, this marks the sixth consecutive year of positive returns and consequently represents the longest gold price rally in history," Deutsche Bank said.

In the past days, the metal gained on speculative buying driven by dollar weakness and tensions in Pakistan following the assassination of opposition leader Benazir Bhutto.

"Certainly we are looking for a test of $850 very early in 2008. All the supportive factors are still there. The dollar is very much under pressure and we have got geopolitical tensions," said James Moore, precious metals analyst at TheBullionDesk.com.

"There is going to be some reallocation of money next year and certainly gold is going to get a favour, as a market to move 30 percent in one direction is going to raise attention."

Spot gold hit a 7-week high of $843.20 an ounce before falling to $837.40/838.20 by 1358 GMT, compared with $837.80/838.50 in New York late on Friday.

Gold was fixed at a record high of $850 in January 1980 on high inflation linked to strong oil, Soviet intervention in Afghanistan and the effects of the Iranian revolution.

After adjusting for inflation, that level was equal to $2,079 at 2006 prices, according to industry estimates. The latest safe-haven buying was sparked by Bhutto's killing last week, which plunged Pakistan into crisis. Electoral officials hold an emergency meeting on Monday to decide whether to go ahead with a January election that is aimed at shifting the country from military to civilian rule.

"Gold spiked to fresh highs on escalating geopolitical tensions, tightening oil supplies and a weakening dollar, which seem to stack the deck in favour of further upward movement," said Pradeep Unni, analyst at Vision Commodities in Dubai.

Dollar's Fall Lends Support

The dollar fell versus a basket of major currencies, keeping it on track for its worst annual performance in four years, as investors speculated that 2008 could bring slower U.S. economic growth and lower interest rates.

A weaker dollar makes gold cheaper for holders of other currencies and often lifts bullion demand. The metal is also generally seen as a hedge against oil-led inflation.

Oil rose to near $97 a barrel, heading for its biggest annual gain this decade, as dwindling fuel stocks and growing concern over political turmoil offset the impact of a softening U.S. economy.

"Gold is likely to consolidate its impressive gains made in 2007. Expectations are for higher peaks to be achieved in the New Year as the unrelenting strength does not look like it will abate anytime soon," Standard bank said in a report.

The Tokyo Commodity Exchange was closed for a holiday. The most-active February gold contract on the U.S. futures exchange fell $1.5 to $841.10 an ounce.

The market awaited U.S. existing home sales data at 1500 GMT and jobs data later in the week for clues on the prospects for U.S. interest rate cuts and the health of the U.S. economy.

Thin trading ahead of the New Year holidays meant gold and other precious metals were prone to sharp fluctuations. Platinum dropped but held near last week's record high of $1,542.

Platinum fell to $1,528/1,532, versus $1,534/1,538 an ounce in New York and last week's record high of $1,542. Silver rose to $14.85/14.90 an ounce from $14.72/14.77 in New York, while palladium gained $2 to $365/368 an ounce.