Anecdotal evidence that the U.S. consumer's marathon spending spree may be slowing to a trot increases daily. By some measures, the U.S. consumer makes up about 19 percent of the world economy and 70 percent of the U.S. economy, so the health of American consumption is key.

Most telling today was the retail sales number for December, which fell 0.4 percent, worse than expected. That number is revving up recession talk on Wall Street and the stock market is taking it hard. Retail stocks are getting slammed across the board.

But it's also the corporate comments about consumer attitudes that we watch, and sometimes they paint a better picture of what's going on.

The warning on the consumer du jour comes from Citigroup already besieged by a host of other troubles. Aside from a massive write down, Citi commented on its the health of its businesses when it released fourth quarter earnings.

Citi says its net consumer credit losses were 5.5 percent and it reserved for more. Already, Capital One told us last week that consumers are getting slower about paying bills and American Express Thursday said its card members just aren't spending like they used to.

More evidence that this behavior is crossing over into the high end came from Williams-Sonoma earlier today.

Williams-Sonoma, which peddles high-end kitchen gadgets and house wares, saw a decline in holiday sales and cut its outlook for the fourth quarter.

It said the macro environment got even weaker than it had expected. Williams-Sonoma also pared back its outlook for the year ahead.

This comes after Tiffany's last week trimmed its profit forecast because of weaker than expected holiday sales, and the Wall Street Journal today reports that auto industry executives are increasingly worried about their luxury car sales. Luxury car sales were down 6.1 percent in 2007.

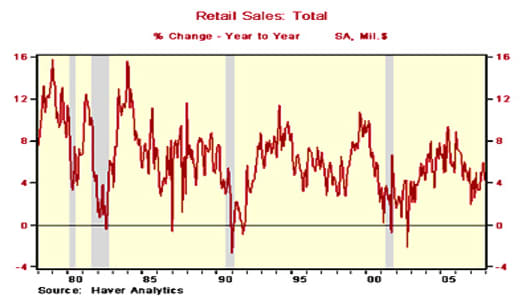

Check out the chart below. We wanted to see whether all the pundits saying the negative retail sales number portends a recession. CNBC's Chief numbers cruncher Ariel Nelson gave us the following chart. The gray bars are periods of recession. Its clear from the chart that the worst retail sales numbers were late in a recession cycle and in one case even after.