The Federal Reserve cut its key interest rate another half point, as expected, and sparked a stock market rally by signaling that further rate cuts are possible.

The Fed's action takes the bellwether federal funds rate target to 3 percent, the lowest since June 2005, and comes just eight days after the central bank made a surprise three-quarters point reduction because of fears the U.S. economy was heading into a recession.

The half-point cut Wednesday followed news that the the U.S. economy grew a weaker than expected 0.6% in the fourth quarter, less than half what had been expected. The report came amid increased concern from several quarters about a possible recession.

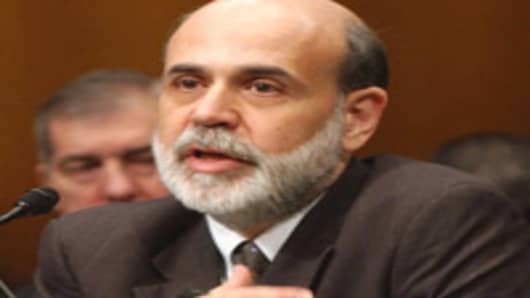

In a brief statement explaining their decision, Federal Reserve Chairman Ben Bernanke and his colleagues said that "financial markets remain under considerable stress."

The Fed move was approved on a 9 to 1 vote. Richard Fisher, president of the Fed's Dallas regional bank, dissented, preferring no change in rates.

The rate cut marked the fifth time that the Fed has cut the funds rate since it started with a half-point cut on Sept. 18 in response to the severe credit crisis which hit global markets in August.

The latest Fed action was expected to be quickly followed by cuts in banks' prime lending rate, the benchmark rate for millions of consumer and business loans. The Fed's hope is that by making credit cheaper, it will encourage more borrowing, giving the economy a needed boost.

The Fed's half-point move met expectations of financial markets and was a bolder move than the smaller quarter-point cut that many economists had been expecting.

In CNBC’s latest “Trillion Dollar Snap Survey”, roughly four out of five respondents said the Fed made the right decision, but only 4 percent would grade Bernanke’s overall performance an “A”. (See full results)

Despite all the recession fears, the economic news lately has been more mixed.

A report Wednesday by ADP Employer Services showed private-sector employers added 130,000 jobs in January, about double what economists expected.

The official Labor Department report on January employment is scheduled for release on Friday.

A report Tuesday showed much stronger-than-expected demand for long-lasting U.S.-made goods in December, while weekly reports have shown initial claims for jobless benefits

declining.