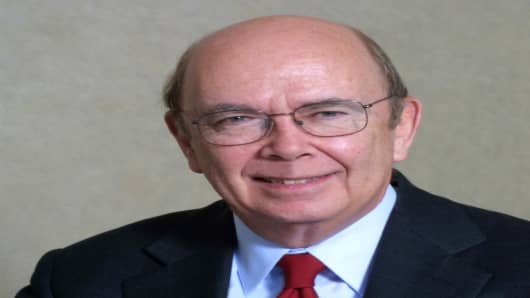

"We're looking at several of the credit insurers and we hope to come to a conclusion, one way or another, very shortly," Ross said, noting he'd signed confidentiality agreements with several.

Ross revealed last week that he was planning to invest more than $1 billion in bond insurers, which have seen their credit rating come under attack amid a collapse in the subprime mortgage sector and a resulting tightening in the credit markets.

Ross has said he anticipates that problems with monoline bond insurers will likely come to a head within the next month or two.

Ross has critized the bond insurer industry for straying from its original model of insuring tax-exempt bonds that rarely default to taking on riskier investments. However, now that that has been done, it is necessary to stabilize the municipal bond issuance.

"Credit ratings are a little bit like virginity," he said. "It's a lot easier to lose it, than to get it back," Ross said Tuesday.

Moody's Investors Service and Standard & Poor's have placed both Ambac and MBIA, the largest bond insurer, on watch for downgrade, while Fitch Ratings has already downgraded Ambac to double-A.