Investors lined up 2 hours before the Apple shareholder meeting began here in Cupertino, California. It's a little unusual for them to be here so early, and I thought it might be related to the company's 40 percent plunge since the beginning of the year.

Instead, I found that euphoria had given way to cautious optimism, but optimism nonetheless, that Apple would continue to rely on innovation to re-capture its stock market magic.

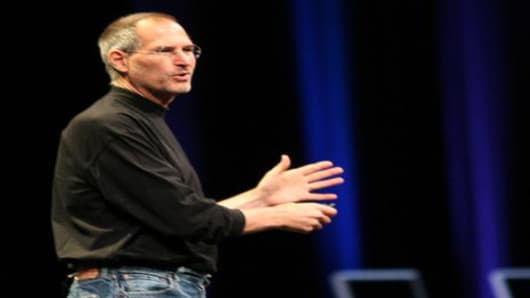

Some significant news did come out of the meeting.Steve Jobs announced Apple has no plans to launch a share buyback program, or offer a dividend to shareholders. There has been widespread discussion of both issues as Apple continues to bank enormous amounts of cash, to the tune of $18.5 billion as of last quarter, and another $1.5 billion in free cash over each of the next several quarters. So that was a disappointment to some.

As board director and recent Nobel Peace Prize winner Al Gore--who also chairs Apple's compensation committee--looked on, the "say on pay" shareholder initiative sponsored by the AFL-CIO, AFSCME, and several institutions actually passed, surprising some who had watched similar proposals at 20 companies so far go down to defeat. Countrywide Financial , Motorola , United Health and others will be hold votes next on the contentious issue.

The same proposal garnered 41 percent of the vote at Apple last year as the company was in the throes of a stock options backdating scandal. But analysts had speculated that if the proposal couldn't pass then, giving shareholders a voice in determining compensation, it had little chance of winning this year. They were wrong.

When the pension rep from AFSCME, Scott Adams, took the mike during the question and answer session ostensibly to crow about the victory, Jobs responded: "I'm hoping that the 'say on pay' proposal will help me with my $1 a year," referring to his salary. Jobs of course didn't mention the ten million Apple options he received in 2000, one of the largest grants ever awarded.

In fact, after the meeting Adams told me he was surprised by the victory, figuring the resolution would attract the same level of support from last year. He calls this a significant victory for shareholders and says the Apple vote will send a clear message that executive compensation needs to be controlled.

Investors also wanted to know whether Apple had any exposure to the sub-prime mortgage mess gripping so many portfolios. Despite its significant cash position, Apple says it sees no exposure of any kind. It says the environment is "concerning," that it's watching investments closely but that all seems fine.

Another investor questioned Jobs and chief operating officer Tim Cook about why there had only been a single meeting with a rep from China Mobile , given the importance of that market. Neither would address the concern directly, only to say that Apple would certainly bring iPhone to China, and India for that matter, but had no announcements to share today.

Interestingly, Jobs was asked about iPhone's sales goals and he, like Cook last week, affirmed Apple's original goal of 10 million iPhones sold by year's end.

I spoke with some shareholders--almost all of whom have held Apple stock long enough to shrug off the steep year-to-date decline. All say they'll continue to hold shares, but one who flew here from Kentucky told me sheepishly he wished he sold a chunk closer to the highs to bank some profits.

Seems like there's a lot of that going around. But not enough to sway the Apple faithful who made their pilgrimage to Cupertino today.

Questions? Comments? TechCheck@cnbc.com