If the words 'recession' and 'stagflation' hadn't added enough to the lexicon of economic doom and gloom in these days of woe, financial markets -- and more importantly the general public -- now have to contend with a new term: 'agflation'. That's agricultural price inflation to you and me.

A trip to your friendly neighborhood Starbucks, supermarket or corner grocery store (if they're still in business) is indeed a sobering lesson in the stark economic realities of supply and demand. From a pint of Guinness in a Dublin pub to a double-shot latte in a Paris cafe, stir-fried pork in a Beijing restaurant to a chili stuffed tortilla in Mexico City, the higher cost of a meal is leaving a distinctly unsettling feeling in the pits of stomachs globally.

With the notable exception of Fed policymakers who continue to use core measures of inflation (which assumes a population that doesn't eat or drive cars) price increases are resonating with even more acuity than they would do otherwise, because of the current backdrop of economic slowdown in the U.S., possibly becoming a recession and spreading.

Given the sheer plurality of factors causing this surge in prices, it’s hard to predict if or when we'll see much relief anytime soon. Global-warming induced draught, improved living standards in developing nations like China and India, the biofuels craze, higher production costs and the recent speculative feeding frenzy in commodities markets as an alternative investment are the main culprits behind surging prices for agricultural commodities.

It's worthwhile taking stock where we stand with prices of commodities that are used in the production of food staples. The price of the wheat used to make your daily loaf has more than doubled in the past year because of declining stockpiles. Wheat futures traded on the Chicago Board of Trade hit a record $13.495 a bushel on February 27.

Premier Foods in the U.K. called the input cost inflation in commodities such as sugar and wheat last year "unprecedented". Chief executive Robert Schofield said the company planned to recover the remaining costs this year, and would pass on further price rises. That means more pain for shoppers.

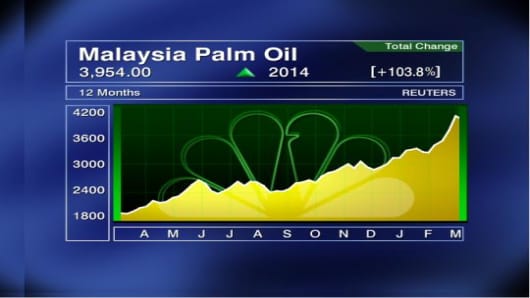

Here in Asia staple foodstuffs including palm oil have soared, raising fears of social instability. Malaysia's benchmark crude palm oil futures contract jumped 8.2 percent to a record 4,332 ringgit a ton this month while Indonesian crude palm oil prices rose 6.5 percent to Rp11.29m a ton.

Bayu Krisnamurti, the deputy minister for agriculture, has warned higher food prices may spark the same type of popular unrest that brought down Suharto as president almost a decade ago. "In 1965 we faced a very, very depressing situation of social unrest," he said. "In 1998 we had a similar situation and we hope in 2008 it's not another situation like that because the cost to the economy is too high," the Financial Times cited the minister as saying.

Such unrest has already erupted in Mexico last year, when protesters took to the streets to protest rising tortilla prices -- the so-called 'tortilla riots'. Attracted by potentially higher returns, farmers planted more corn for biodiesel production. Acreage earmarked for food crops fell, creating shortages and forcing prices higher.

Clearly, the inflationary pressures wrought by high food prices pose a huge challenge for emerging markets especially here in Asia.

Jonathan Garner, Morgan Stanley’s head of emerging markets told CNBC, governments in Asia have sufficient surpluses to increase subsidies, protecting their populations from future price rises.

China is focused on tackling inflation which hit an 11-year high of 7.1% in January. In his annual work report to Chinese lawmakers Chinese Premier Wen Jiabao said Beijing will take steps to boost supply of products, increasing production of grains, edible oils and meat as it seeks to keep inflation to no more than 4.8 percent. Food prices have soared so much that in China, the price of pork today is almost 60 percent higher than it was in January 2007.

The outlook for the supply picture globally doesn't look positive. The UN’s Food and Agriculture Organisation said world food stocks are at record lows at about 157 million tons, against more than 200 million tons in 2003. U.S. wheat stocks are projected to fall to their lowest in 60 years by May. It hasn’t helped matters that speculators have zeroed in on the bull trends in resources and contributed to the jump in prices by "buying the hell" out of everything from soybeans to live hog futures, to quote one trader never known for mincing his words.

As dire as the outlook looks for world food supply, there’s no shortage of investors who continue to talk up the bull story for agricultural commodities, perhaps the most vocal advocate being the bow-tied globetrotting Jim Rogers.

"Rogers pretty much sees the American economy slowing to a crawl, so much that only the hunger drive can keep the U.S. from flat-lining completely," Maurna Desmond wrote in Forbes last month. "He recommends agriculture and other commodities as good investments during hard times."

And he's not alone. Hong Kong-based investment guru Marc Faber also subscribes to the boom in food commodities and even goes a step further, suggesting rurally inclined investors "buy a farm and learn to drive a tractor."

From a policy perspective, many countries are seeking to limit exports to ease food shortages at home. While this may appear an immediate solution to the escalating food prices, the International Food Policy Research Institute argues this could aggravate rather than improve world commodity markets.

A 'starve your neighbor' policy would inevitably make prices more volatile since countries would trade smaller shares of total world production of agricultural products, IFPRI director general Joachim von Braun says. The answer lies in "freer trade … especially when we have scarcity" and as the world’s biggest economy, the onus is on the U.S. to do everything in its power to push stalled world trade talks to a conclusion, according to von Braun.

Food for thought for the incoming administration.

Send Sri your questions and comments at commoditystore@cnbc.com.