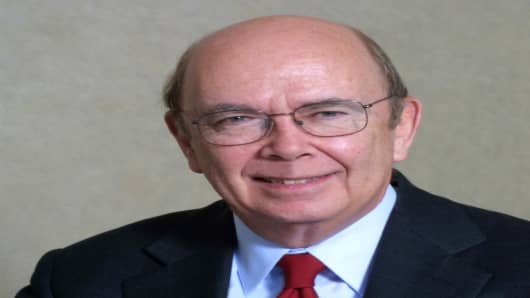

Investor Wilbur Ross on Thursday said he bought about $1 billion of U.S. municipal bonds last Friday because yields had risen to "relatively unparalleled" highs compared with taxable Treasuries.

"A lot of hedge funds were getting margin calls because of the dislocation in the muni market," Ross told Reuters by telephone, adding that his purchases included California munis that offered yields of around 5.50 percent.

Asked if he bought a portfolio of bonds from hedge fund Duration Capital, he said: "I am not in a position to confirm who was selling."