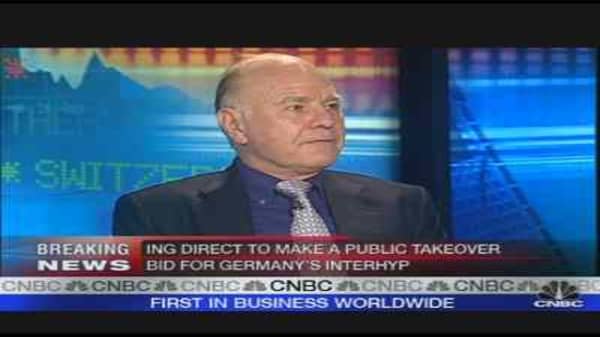

The credit crunch is far from over and is likely to hit sectors other than housing, Marc Faber, Editor and Publisher of “The Gloom, Boom & Doom Report”, told "Squawk Box Europe."

Consumers will cut spending because of the high oil and energy prices, and all that the recent rally in stocks has shown is that investors think shares offer a better cushion against inflation than bonds, Faber added.

"I personally think we are just starting the credit crunch and it is going to be worse," he said. "I think the economy really stinks and the next sector to be hit, in America and elsewhere, is retail."