Brazil is a global leader in energy, agricultural, technology, and industrial sectors, with transportation equipment and parts accounting for $14.3 billion in 2007, followed by metal goods at $9.8B, and agricultural products at $9.8B, according to The Economist

Brazil is also a pioneer of ethanol production as well as deep water-oil research

In April 2008, Standard & Poor’s upgraded Brazil’s long-term foreign-currency credit rating from BB+ to BBB- for the first time in the history of the country, potentially opening the door to further foreign investment.

The Brazilian real has appreciated by 11.41% year-to-date against the US dollar, with one US dollar purchasing 1.576 reais.

Brazil’s current interest rate stands at 13.00%

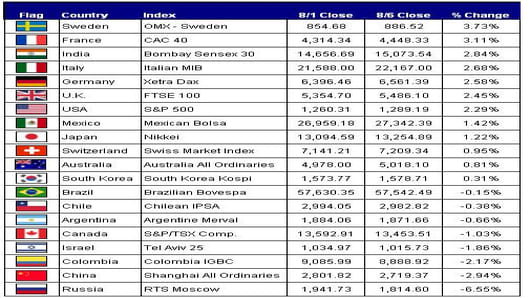

Markets: Brazil’s Stock Exchange (BOVESPA) is Latin America’s largest stock exchange tracing it roots back to August 1890.

- Brazil’s BOVESPA is off by 28.82% from its record intraday high of 73,920.38, hit on May 29, 2008

- Year-to-date, it is down 10.21%

- From 12/06 to 12/07, Brazil’s BOVESPA was up 43.65%

Some Winning Brazilian ADRs traded in the US include:

- Tele Norte Celular Participacoes (TCN), up 41% year-to-date (YTD)

- Gerdau (GGB), up 41% YTD

- Companhia Paranaense de Energia (ELP), up 35% YTD

- Sadia (SDA), up 34% YTD

- Companhia Energetica de Minas Gerais (CIG), up 28% YTD

- Companhia Brasileira de Distribuicao (CBD), up 27% YTD

- Companhia Siderurgica Nacional (SID), up 24% YTD

- Tele Norte Leste Participacoes (TNE), up 24% YTD

- CPLF Energia (CPL), up 21% YTD

- Telemunicacoes de Sao Paulo (TSP), up 19% YTD

Some Brazilian ETFs include:

- iShares MSCI Brazil Index (EWZ), down 3.77% YTD

- Wisdom Tree Dreyfus Brazilian Real Fund (BZF), up 3.86% in the last three months

Check in daily for more updates and country profiles. bythenumbers.cnbc.com

Send comments tobythenumbers@cnbc.com