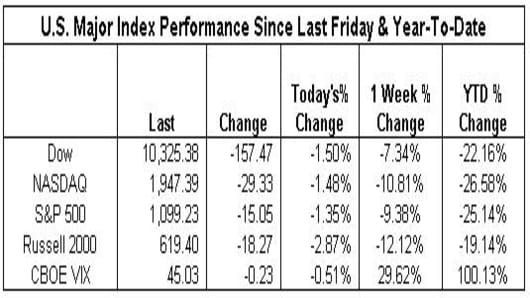

The $700B US Bailout was signed into law on Friday, and the major markets still closed down for the day after a brief rally. The week was devastating to the US stock market with a 7.34% weekly loss for the Dow, an over 9% drop for the S&P and an almost 11% drop for the NASDAQ.

*The last time the Dow, NASDAQ, & S&P were all down 7.3% or greater was October 1987

*The Dow swung within an almost 800 point range, the majority on Monday

*The VIX hit a new 52-wk high of 48.40 on Monday

-IBM had the most negative impact on the Dow down over 13% for the week

-Procter & Gamble had the most positive impact on the Dow & the S&P, up over 3% for the week

*Only 4 Dow components were positive for the week: PG, PFE, KFT, KO

-General Electric had the most negative impact on the S&P, down almost 15% for the week

-Apple had the most negative impact on the NASDAQ 100, down over 24% for the week

-Biogen Idec had the most positive impact on the NASDAQ 100, up almost 2% for the week

*Only 3 NASDAQ 100 constituents were positive for the week: BIIB, HANS, TEVA

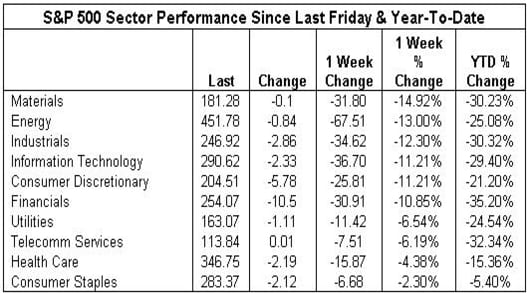

The S&P 500 sectors were all negative for the week led by Materials, for the second week running down almost 15%. The least negative sector was Consumer Staples, down over 2% for the week.

-Materials were dragged down by Freeport-McMoran down over 30% for the week

-Consumer Staples were helped by Campbell Soup up over 5% the week

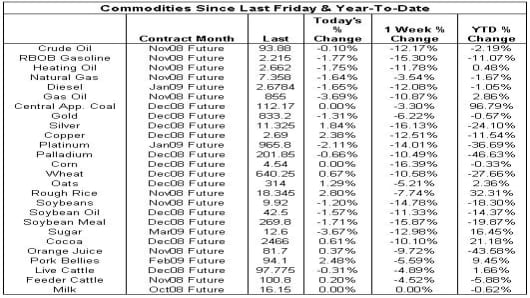

Commodities sold off broadly, as the CRB Index ended the week down more than 10%, or its worst weekly slide since September 1956 (The CRB is a basket of 19 commodities including petroleum, softs, precious metals, industrial metals, livestock, grains and natural gas).

-Oil falls on demand concerns, down over 12% for the week

-Gold is off over 6% for the week

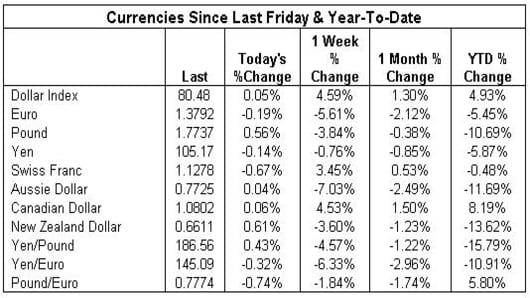

The US Dollar ends the week up against most major currencies, especially the euro and pound, but loses some ground to the yen.

-The Euro is poised for its worst weekly performance against the US dollar ever. Currently the euro is down almost 6% against the dollar, and the previous worst weekly decline was about 4% in May, 1995.

-The Australian dollar is also poised for its biggest weekly drop against the US dollar in 20 years, down about 7%

*Economic concerns fuel the drop as well as the fall in commodities as Australia is a major exporter of natural resources