The Dow dropped below 9,600 Monday after global markets took a pounding amid fear that the credit crisis is spreading around the globe.

The Dow Jones Industrial Average was down more than 700 points, or 7 percent, falling through 10,000 and quickly breaching 9,900, 9,800, 9,700 and 9,600 in rapid succession, levels it hasn't seen in nearly four years. The Dow first hit 10,000 at the end of March, 1999. (Track the Dow winners and losers.)

"There are absolutely no buyers," Matt Cheslock, a senior specialist at Cohen Specialists, And with the credit markets frozen, "equities are a source of liquidity right now," he said.

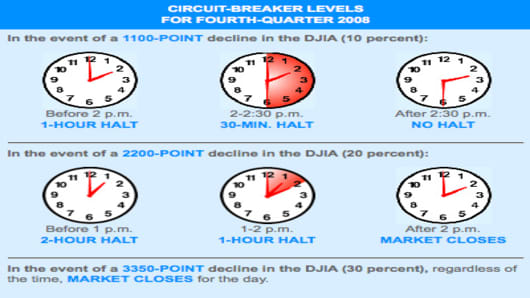

To put the Dow's decline in perspective, we're not even halfway to the first circuit-breaker trigger levelannounced by the NYSE last week. According to the fourth-quarter guidelines, an 1100-point drop in the Dow before 2 p.m. will halt trading for one hour, a 2200-point drop before 1 p.m. will stop trading for two hours, and a 3350-point drop will shut down trading for the rest of the day, regardless of what time it occurs.

"We'd actually like to see a little more panic," Cheslock said. "Then you get stocks that go down and bounce," enticing buyers, he said. "Eighteen percent might seem like a discount but when you don't get a bounce it's not. The stock could go down another 2 percent," he explained.

The S&P 500 was down about 7 percent, while the Nasdaq lost more than 7 percent. The CBOE Volatility Index, widely considered the best gauge of fear in the market, soared to a record above 50.

There were nearly 1,000 new intraday lows set on the New York Stock Exchange, the highest since 1998. And 48 percent of stocks in the U.S. are sitting at 52-week lows.

The fear sent a ripple through markets around the world: Latin American markets were at their session lows; trading was halted twice in Brazil after the index dropped 15 percent. European stock markets had their worst day in four years, with most indexes shedding 7 percent or more, amid fear that the credit crisis has spread to European banks. Asian markets also took a hit, with Japan's Nikkei 225 Average dropping more than 4 percent.