Warren Buffett's celebrity-style endorsements of General Electric and Goldman Sachs haven't paid off in higher stock prices for the two companies -- at least not yet.

Buffett's words of praise for GE and Goldman were featured prominently in the announcements of Berkshire Hathaway's $5 billion investment in Goldman on September 23 and its $3 billion injection into General Electric on October 1.

GE shares have dropped almost 10 percent since just before the news hit, and they were down almost 17 percent at Monday's 11-year low of $19.69. Even in the hours after Buffett's endorsement, GE had to price its $12 billion common stock offering below the market.

Goldman is doing relatively better. It's only down just under 1 percent since Buffett arrived on the 23rd.

Buffett certainly didn't hold back in his glowing descriptions of the two companies.

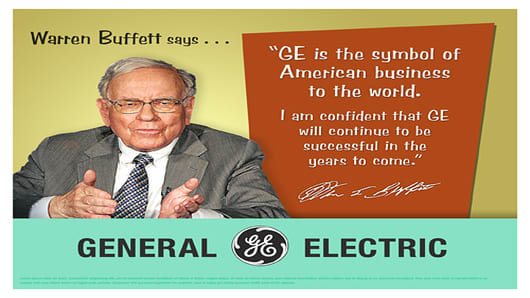

In the Berkshire/GE news release , paragraph three, he says, "GE is the symbol of American business to the world. I have been a friend and admirer of GE and its leaders for decades. They have strong global brands and businesses with which I am quite familiar. I am confident that GE will continue to be successful in the years to come."

(I couldn't help remembering those old magazine ads in which a movie star or sports hero talks about his or her devotion to a certain automobile or brand of soap flakes.)

In his live interview on CNBC minutes later, Buffett called GE "the backbone of American industry" and predicted that it will move higher over the next five to ten years.

In the Goldman news release , Buffett says in paragraph four, "Goldman Sachs is an exceptional institution. It has an unrivaled global franchise, a proven and deep management team and the intellectual and financial capital to continue its track record of outperformance."

"There's no better firm on Wall Street," he told our Becky Quick in a live interview the next morning .

GE and Goldman paid a premium for Buffett's money and support. The preferred shares return a hefty annual dividend of 10 percent.

Part of that premium pays for Buffett's willingness to do a deal almost instantly. If you need cash quickly, Buffett is the person you need to call these days, but he'll make it worth his while.

But it's not just cash. GE and Goldman are also paying for the endorsement of the world's best-known, most-successful, and universally-trusted investor.

As Knight Capital Group's Peter Kenny put it in the Los Angeles Times , "It's not just money. It's brand. Buffett's dollars are worth more than other people's dollars."

Not everyone agrees. While Buffett's endorsement of GE has generally been seen as a positive in the marketplace, there are those who argue the Omaha billionaire's ability to get such favorable terms in his deal with the giant conglomerate doesn't bolster their confidence in GE's future.

So, did Goldman and GE get their money's worth?

While they don't have a higher short-term stock price at the moment, they did get Buffett to put billions of dollars on the line, proof of his long-term confidence that'll survive for the long-term.

In the middle of a financial crisis that has a lot of people questioning their basic assumptions about the future, that's got to be worth something.

Current stock prices:

Berkshire Class A:

Berkshire Class B:

General Electric:

Goldman Sachs:

General Electric is the parent company of CNBC.

Questions? Comments? Email me at buffettwatch@cnbc.com