As investors continue to debate whether the stock market could be near a bottom, data for the last twelve bear markets indicates that, on average, it took the Dow three years to reach its previous highs. Assuming that the last three bear markets could resemble the current economic slowdown, the average jumps to four years.

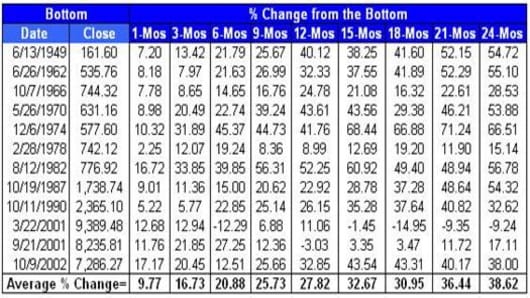

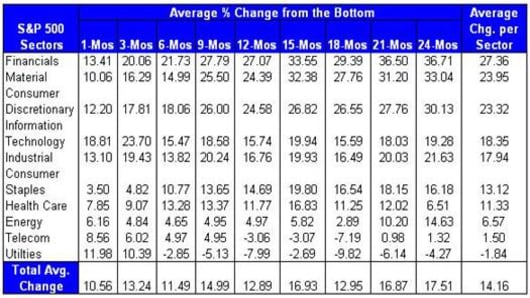

Identifying the bottom is important because the biggest gains come within the first year of market bottoms -the Dow posted an average gain of 27.82% within one year of the previous bear bottoms.

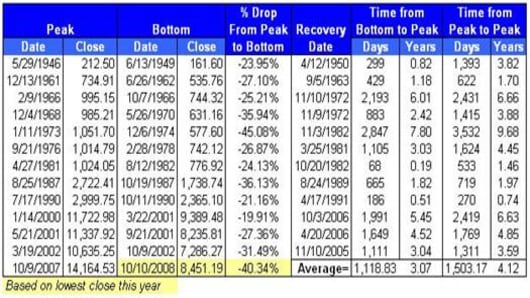

Birinyi Associates, a stock market research and money management firm, has identified thirteen bear markets since the end of World War II. The average decline for the past twelve bear markets was 28.69%. Based on the lowest close this year, the Dow Jones Industrial Average index is off by 40.34% from its peak of 14,164.53 on October 9, 2007.