You've sent for your credit report and paid extra for your credit score. Now what?

You probably sent for it because you want to know one thing: How good (or bad) is your credit?

But instead of a straight answer for your trouble, your report consists of a list of current and past debts plus a number. And what that number means can vary widely.

"Every company sets its own criteria," says Maxine Sweet, vice president of public education for Experian, one of the three major credit bureaus.

At the same time, that number is becoming more important in everyday life, as everyone from insurance companies to potential employers have started looking at credit histories and scores.

"More nontraditional types of entities are using credit scores," says Janet Garkey, editor with the Credit Union National Association's Center for Personal Finance.

While credit ratings and credit scores take on more meaning and importance in everyday life, so do the misunderstandings and misconceptions that surround them.

Myth: There's just one type of credit score.

"There are a lot of different scoring models out there," Garkey says. Making it even more confusing, different creditors will look at different factors, she says. "They don't necessarily look at the same thing."

_____________________________________

More Stories from Bankrate.com:

- Life Without Credit: Tough and Expensive

- The Dos and Don't of Establishing Credit

- How to Tell if Your Retirement Plans are on Track

_____________________________________

Many larger financial institutions have their own scoring system (which you may or may not ever see). Credit bureaus also have their own separate scoring system, which they sell to creditors and consumers. Several years ago, the three bureaus banded together to introduce a new numerical rating system.

Dubbed the Vantage score, it runs from 501 to 990 and also gives consumers an academic letter grade.

But when it comes to credit scores, one of the most common versions is the FICO score. "It's the 800-pound gorilla," says Craig Watts, public affairs manager with Fair Isaac Corp., the company that pioneered credit scoring and introduced FICO scores nearly 20 years ago.

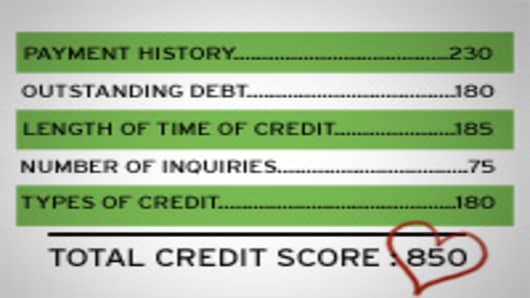

A FICO score can range from 300 (very bad) to 850 (very good). The median is 723, according to Fair Isaac statistics.

Some reassuring news: The majority of consumers still have good credit. Forty-five percent of consumers have a score between 700 and 799, and 13 percent score above 800, according to statistics from Fair Isaac.

Just like the SATs, perfect scores are rare. Even though 850 FICO scores do exist, high scores taper off around 825, says Sweet. "You can't get much better -- that's pretty much walking on water," she says.

Now for the rest of the population: 27 percent rank above 600, and 13 percent weigh in above 500. Only 2 percent have 500 or below, according to Fair Isaac numbers.

Myth: There's only one yardstick for assessing what the numbers mean.

Even with the same brand of credit score, different lenders will set different ranges for what constitutes good, better and solid-gold credit ratings.