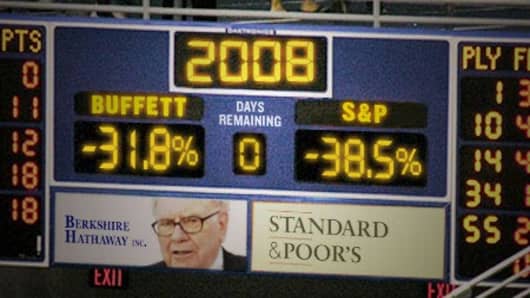

Shares of Warren Buffett's Berkshire Hathaway lost almost a third of their value in 2008, but the stock still managed to outperform the benchmark S&P 500 stock index for the third consecutive year.

Berkshire's Class A shares ended the year at $96,600 each. That's a drop of 31.8 percent from 2007's closing price of $141,600. It's Berkshire's worst performance in the roughly three decades for which we have data.

The S&P fell 38.5 percent during 2008, excluding dividends, its worst year since 1931.