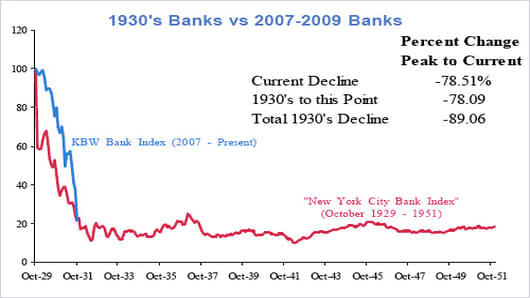

The wreck that was the banking sector this week actually made history.

According to Jeff Rubin of Birinyi Associates, bank stocks have fallen further and faster than at any time in history, including the Great Depression.

Rubin said on Tuesday, the day of their big sell off, bank stocks were down 78.51 percent from their February, 2007 high. At a parallel point in the 1930s (two years from their high), bank stocks were down 78.09 percent.

It's not a huge difference but ultimately, bank stocks lost a total 89 percent in the Depression era. It took them another nine months from the two-year mark to get there.

"I think the real point here is everyone is looking for a quick rebound in the financials. If you're looking for any guidance, the only guidance we have is the Great Depression. We went 20 years without a rebound. It was sideways until the 1950s, at least for the banks," he said.

Financials are now at an 18-year low in terms of weighting in the S&P 500. They are at 9.99 percent. Tech was in first place, with 16.1 percent and health care was a close second at 15.83.

Earnings news blew up what could have been a second up day for stocks, and it was Microsoft's surpise release of a worse than expected quarter that really sent stocks spinning.

Financials though continue to lead the decline, down about 6 percnet today, while tech is down 3.2 percent. Some of the worst performers are Huntington Bancshares, Fifth Third, Aflac, Citigroup, SLM and Bank of America..

Rubin shared this chart with us.