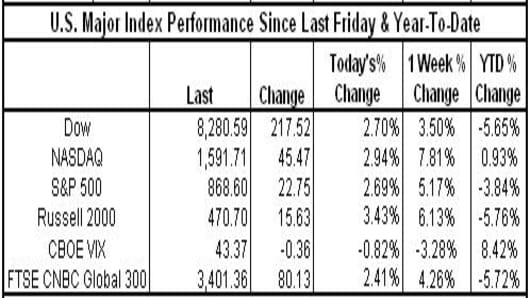

The market rallied with most major indexes up 5% or greater for the week with the NASDAQ gaining almost 8%. The Dow brought up the rear, gaining 3.5% for the week. The markets shrugged off grim jobs data and were buoyed by the bank bailout plan expected on Monday.

**As techs lead the rally, the NASDAQ Composite is now positive for the year, up almost 1% in 2009, and the NASDAQ 100 is up almost 5.5% YTD.

Index Impact:

-IBM (IBM) had the most positive impact on the Dow, for the second week running, up almost 5% for the week.

**YTD, the top Dow performer by % gain is also IBM up over 14% YTD

-Kraft (KFT) had the most negative impact on the Dow, down over 6% for the week

**YTD Bank of America (BAC) is still the worst Dow performer by % loss, down over 56% YTD.

-Microsoft (MSFT) had the most positive impact on the S&P 500 and the NASDAQ 100, up almost 15% for the week.

**YTD, the top S&P performer by % gain is still Micron (MU) up almost 55% YTD

**YTD the top NASDAQ 100 performer by % gain is Sun Microsystems (JAVA), up 50% YTD

-General Electric (GE) had the most negative impact on the S&P 500, down over 8% for the week

**YTD, Huntington Bancshares (HBAN) is the worst S&P performer by % loss, down over 69% YTD.

-Comcast (CMCSA) had the most negative impact on the NASDAQ 100, down over 3% for the week.

**YTD the worst NASDAQ 100 performer by % gain remains Logitech (LOGI), down more than 34% YTD

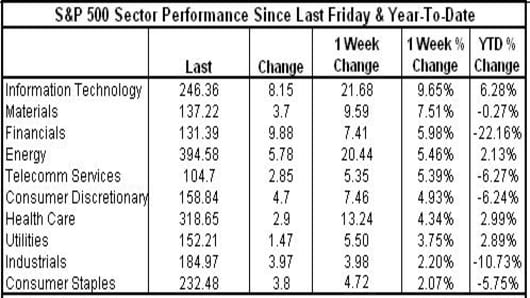

10 out of 10 S&P sectors were positive for the week led by Information Technology up almost 10% for the week. Consumer Staples was the weakest group for the week, up slightly over 2%.

*YTD 4 out 10 S&P sectors moved into positive territory this week led by Information Technology up over 6% YTD, followed by Health Care and Utilities up about 3% YTD, and Energy up over 2% YTD.

Information Technology was helped by Sun Microsystems (JAVA) up almost 38% for the week

Consumer Staples were hurt by Kraft (KFT) down over 6% for the week

The market rallied with most major indexes up 5% or greater for the week with the NASDAQ gaining almost 8%. The Dow brought up the rear, gaining 3.5% for the week. The markets shrugged off grim jobs data and were buoyed by the bank bailout plan expected on Monday.

**As techs lead the rally, the NASDAQ Composite is now positive for the year, up almost 1% in 2009, and the NASDAQ 100 is up almost 5.5% YTD.

Index Impact:

-IBM (IBM) had the most positive impact on the Dow, for the second week running, up almost 5% for the week.

**YTD, the top Dow performer by % gain is also IBM up over 14% YTD

-Kraft (KFT) had the most negative impact on the Dow, down over 6% for the week

**YTD Bank of America (BAC) is still the worst Dow performer by % loss, down over 56% YTD.

-Microsoft (MSFT) had the most positive impact on the S&P 500 and the NASDAQ 100, up almost 15% for the week.

**YTD, the top S&P performer by % gain is still Micron (MU) up almost 55% YTD

**YTD the top NASDAQ 100 performer by % gain is Sun Microsystems (JAVA), up 50% YTD

-General Electric (GE) had the most negative impact on the S&P 500, down over 8% for the week

**YTD, Huntington Bancshares (HBAN) is the worst S&P performer by % loss, down over 69% YTD.

-Comcast (CMCSA) had the most negative impact on the NASDAQ 100, down over 3% for the week.

**YTD the worst NASDAQ 100 performer by % gain remains Logitech (LOGI), down more than 34% YTD

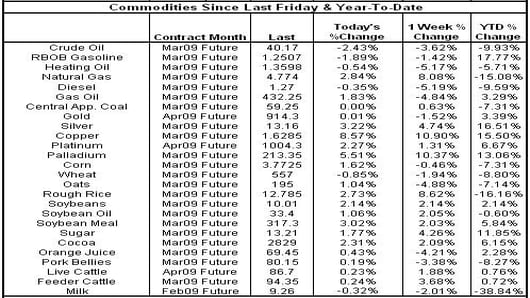

Oil dipped below $40 per barrel this week on extended fears of a deepening recession, however, it erased most of its losses on Friday to settle at $40.17 per barrel.

Gas Prices: The AAA current national average for regular gas is $1.910 per gallon down 35.73% from a year ago when the average was $2.972 per gallon

-The highest recorded average price by AAA was on 7/17/2008, when the national average was $4.114 per gallon

The market rallied with most major indexes up 5% or greater for the week with the NASDAQ gaining almost 8%. The Dow brought up the rear, gaining 3.5% for the week. The markets shrugged off grim jobs data and were buoyed by the bank bailout plan expected on Monday.

**As techs lead the rally, the NASDAQ Composite is now positive for the year, up almost 1% in 2009, and the NASDAQ 100 is up almost 5.5% YTD.

Index Impact:

-IBM (IBM) had the most positive impact on the Dow, for the second week running, up almost 5% for the week.

**YTD, the top Dow performer by % gain is also IBM up over 14% YTD

-Kraft (KFT) had the most negative impact on the Dow, down over 6% for the week

**YTD Bank of America (BAC) is still the worst Dow performer by % loss, down over 56% YTD.

-Microsoft (MSFT) had the most positive impact on the S&P 500 and the NASDAQ 100, up almost 15% for the week.

**YTD, the top S&P performer by % gain is still Micron (MU) up almost 55% YTD

**YTD the top NASDAQ 100 performer by % gain is Sun Microsystems (JAVA), up 50% YTD

-General Electric (GE) had the most negative impact on the S&P 500, down over 8% for the week

**YTD, Huntington Bancshares (HBAN) is the worst S&P performer by % loss, down over 69% YTD.

-Comcast (CMCSA) had the most negative impact on the NASDAQ 100, down over 3% for the week.

**YTD the worst NASDAQ 100 performer by % gain remains Logitech (LOGI), down more than 34% YTD

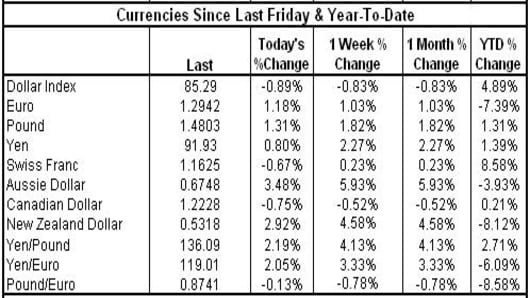

The US dollar continued to be under pressure this week, but rallied against the yen on Friday. The yen was weaker against the euro and pound sterling as trader's risk appetite grew and the US stock market rallied.

-The stabilization of risk appetite has helped the Australian dollar against the US Dollar which had been trading at 5-year lows but rallied Friday, the Aussie dollar also gained almost 5% against the yen.

The market rallied with most major indexes up 5% or greater for the week with the NASDAQ gaining almost 8%. The Dow brought up the rear, gaining 3.5% for the week. The markets shrugged off grim jobs data and were buoyed by the bank bailout plan expected on Monday.

**As techs lead the rally, the NASDAQ Composite is now positive for the year, up almost 1% in 2009, and the NASDAQ 100 is up almost 5.5% YTD.

Index Impact:

-IBM (IBM) had the most positive impact on the Dow, for the second week running, up almost 5% for the week.

**YTD, the top Dow performer by % gain is also IBM up over 14% YTD

-Kraft (KFT) had the most negative impact on the Dow, down over 6% for the week

**YTD Bank of America (BAC) is still the worst Dow performer by % loss, down over 56% YTD.

-Microsoft (MSFT) had the most positive impact on the S&P 500 and the NASDAQ 100, up almost 15% for the week.

**YTD, the top S&P performer by % gain is still Micron (MU) up almost 55% YTD

**YTD the top NASDAQ 100 performer by % gain is Sun Microsystems (JAVA), up 50% YTD

-General Electric (GE) had the most negative impact on the S&P 500, down over 8% for the week

**YTD, Huntington Bancshares (HBAN) is the worst S&P performer by % loss, down over 69% YTD.

-Comcast (CMCSA) had the most negative impact on the NASDAQ 100, down over 3% for the week.

**YTD the worst NASDAQ 100 performer by % gain remains Logitech (LOGI), down more than 34% YTD

Comments? Suggestions? Send them tobythenumbers@cnbc.com

Bythenumbers.cnbc.com