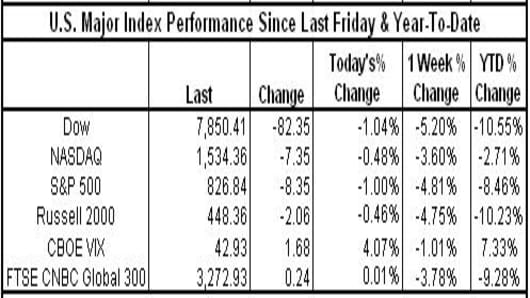

On a week dominated by the $787B stimulus plan passed by the House, with the Senate scheduled to start the vote at 5:30pET Friday, the markets came close to retesting their November lows to end the week down 3.5% or greater. The markets await news out of the G7 meeting in Rome regarding the global economic crisis, with a focus on excess volatility in the currency markets and collaboration versus protectionism.

**Today's 4th consecutive close below 8,000 for the Dow marks the Dow's longest closing streak below 8,000 since March 2003.

**The NASDAQ 100 index is one of the only major US indexes to hold on to its positive gains for the year, up 2.08% YTD; the NASDAQ composite is now down 2.71% YTD. The Dow and the Russell are both down over 10% YTD.

Index Impact:

-Coca-Cola (KO) had the most positive impact on the Dow, up almost 1% for the week.

**Year-to-date, the top Dow performer by percent gain remains IBM up almost 12%; all other Dow components are negative YTD

-Exxon (XOM) had the most negative impact on the Dow and the S&P, down over 7% for the week

**YTD, Bank of America (BAC) continues to be the worst Dow performer by percent loss, down over 60% YTD

**YTD, Huntington Bancshares (HBAN) is the worst S&P performer by percent loss, down almost 78% YTD.

-General Electric (GE) had the most positive impact on the S&P 500, up over 3% for the week.

**YTD, the top S&P performer by percent gain is Sprint Nextel (S) up over 54% YTD

-Teva Pharma (TEVA) had the most positive impact on the NASDAQ 100, up almost 5% for the week.

**YTD, the top NASDAQ 100 performer by percent gain is Illumina (ILMN), up almost 38% YTD

-Research in Motion (RIMM) had the most negative impact on the NASDAQ 100, down over 18% for the week.

**YTD, the worst NASDAQ 100 performer by percent gain is Wynn Resorts (WYNN), down over 38% YTD

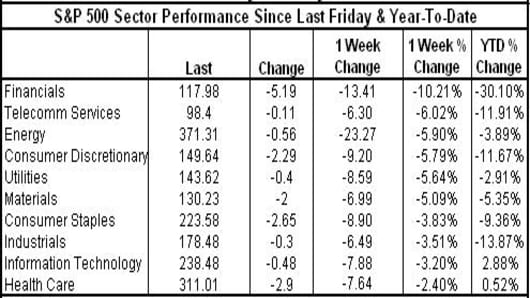

10 out of 10 S&P sectors were negative for the week led by Financials down over 10% for the week. Health Care was the best performing group for the week, down 2.40%.

*YTD Technology and Health Care are the only two sectors positive YTD, up 2.88% and 0.52% YTD respectively.

Financials were dragged down by Principal Financial (PFG) down almost 31% for the week

Health Care was helped by Davita (DVA) up over 12% for the week.

On a week dominated by the $787B stimulus plan passed by the House, with the Senate scheduled to start the vote at 5:30pET Friday, the markets came close to retesting their November lows to end the week down 3.5% or greater. The markets await news out of the G7 meeting in Rome regarding the global economic crisis, with a focus on excess volatility in the currency markets and collaboration versus protectionism.

**Today's 4th consecutive close below 8,000 for the Dow marks the Dow's longest closing streak below 8,000 since March 2003.

**The NASDAQ 100 index is one of the only major US indexes to hold on to its positive gains for the year, up 2.08% YTD; the NASDAQ composite is now down 2.71% YTD. The Dow and the Russell are both down over 10% YTD.

Index Impact:

-Coca-Cola (KO) had the most positive impact on the Dow, up almost 1% for the week.

**Year-to-date, the top Dow performer by percent gain remains IBM up almost 12%; all other Dow components are negative YTD

-Exxon (XOM) had the most negative impact on the Dow and the S&P, down over 7% for the week

**YTD, Bank of America (BAC) continues to be the worst Dow performer by percent loss, down over 60% YTD

**YTD, Huntington Bancshares (HBAN) is the worst S&P performer by percent loss, down almost 78% YTD.

-General Electric (GE) had the most positive impact on the S&P 500, up over 3% for the week.

**YTD, the top S&P performer by percent gain is Sprint Nextel (S) up over 54% YTD

-Teva Pharma (TEVA) had the most positive impact on the NASDAQ 100, up almost 5% for the week.

**YTD, the top NASDAQ 100 performer by percent gain is Illumina (ILMN), up almost 38% YTD

-Research in Motion (RIMM) had the most negative impact on the NASDAQ 100, down over 18% for the week.

**YTD, the worst NASDAQ 100 performer by percent gain is Wynn Resorts (WYNN), down over 38% YTD

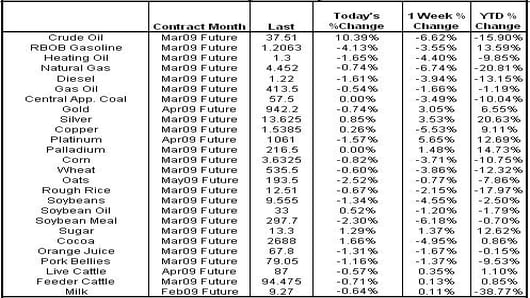

Crude oil for March delivery settled up over 10% at $37.51 per barrel but closed down almost 7% for the week. Gold continued to rally this week, though some profit-taking did happen on Friday as gold for April delivery settled at $942.20 per oz, after gaining over 11% this week.

Gas Prices: The AAA current national average for regular gas is $1.961 per gallon down 34.17% from a year ago when the average was $2.979 per gallon

-The highest recorded average price by AAA was on 7/17/2008, when the national average was $4.114 per gallon.

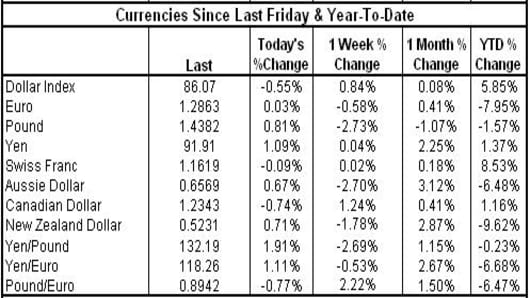

The US dollar gained ground against the pound sterling this week, but began to retreat on Friday as the markets await news out of G7 and the vote on the stimulus plan. The dollar rebounded against the yen as traders listen for any policy that may impact the "excessive strength" of the yen.

Crude oil for March delivery settled up over 10% at $37.51 per barrel but closed down almost 7% for the week. Gold continued to rally this week, though some profit-taking did happen on Friday as gold for April delivery settled at $942.20 per oz, after gaining over 11% this week.

Gas Prices: The AAA current national average for regular gas is $1.961 per gallon down 34.17% from a year ago when the average was $2.979 per gallon

-The highest recorded average price by AAA was on 7/17/2008, when the national average was $4.114 per gallon.

Comments? Suggestions? Send them tobythenumbers@cnbc.com

Bythenumbers.cnbc.com