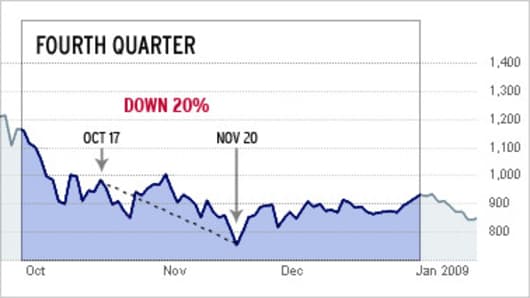

Exactly four months ago today, on October 17, Warren Buffett wrote an op-ed piece for the New York Times with one of his rare, specific market calls for investors: "Buy American. I Am."

He explained how falling stock prices had prompted him to pick up U.S. stocks at bargain prices .. for his personal account.

At that time he said, "If prices keep looking attractive, my non-Berkshire net worth will soon be 100 percent in United States equities."