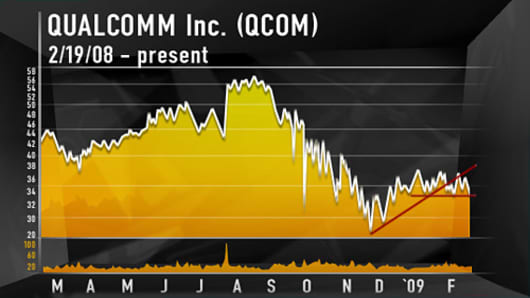

Qualcomm’s performance chart is screaming sell. Even though technology stocks have rallied in recent weeks, Qualcomm can’t surpass its January highs. Nor has this company outperformed other semiconductors or the Nasdaq as a whole. These are just a few signs, technical analysts say, that QCOM can’t be owned.

Remember, technical analysis is the study of stock charts as a way to predict future performance. Cramer’s not a fan – he focuses on business fundamentals instead – but the practice is so widely used by Wall Street’s biggest money managers that investors must take note. After all, these are the guys who move the markets.

According to technicians, QCOM’s failure to reach beyond its January highs means that buyers just aren’t interested in the stock. And the company’s inability to keep pace with its peers shows a lack of “relative strength,” technical jargon for the measure of how well a stock is doing versus its sector. Qualcomm also broke its “uptrend line” – the rate at which a stock is going higher or lower – indicating a slower increase in share price.

Even worse from a technical perspective, though, is that Qualcomm broke through that line on high volume and on a “gap down.” In technical analysis, volume dictates the legitimacy of a stock’s move. The bigger it is, the more chartists trust it. A gap is the term for a small number of trades. In this case, from buyers, as they backed off and sellers took over. Strong buying interest will usually fill a gap immediately, but that didn’t happen with Qualcomm. It’s another sign that demand is waning.

You can see these movements in the chart below. The diagonal red line is the uptrend line, and the horizontal one is the support line. The latter is important because one of Cramer’s favorite technicians said QCOM will break through its support – the $33 mark – the next time the stock goes down. Normally the support line indicates the point at which a stock will rally back up. But this technician thinks QCOM could fall as low as $30 without the promise of regaining its losses.