People come up with all kinds of formulas to determine which way the stock market will go.

Craig Forgrave says he's hit a winning formula by examining which movies do well at the box office.

Um, What?

Forgrave runs MarketBOB.com, which he says was up 18 percent last year, while the Dow was down 34 percent.

Forgrave believes the movies Americans favor reflect their mood, and potentially their desire to buy or sell stocks.

Also, he believes that if consumers feel disappointed by the movies they spend money on, that, too, can affect their overall confidence.

Here's how it works. Forgrave takes a weekend box office champ and scores it by genre, quality, and storyline. Based on that, he predicts how the Dow will do the following week. Genres which predict a bull market include comedies, family films, and romance. However, quality has a "greater influence on market direction than genre" because it reflects value. "If you leave the theater feeling ripped off, your investment of time and money was wasted, and your confidence is down." Finally, the storyline is important because, "If the main character is depressed, so are you. If the main character is bold, you will be, too."

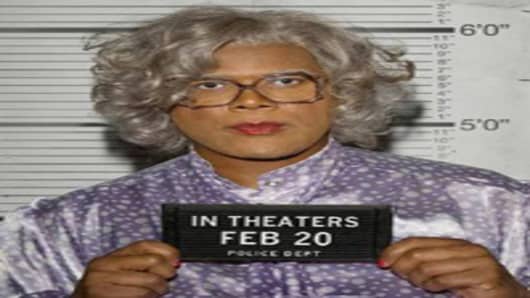

MarketBOB claims it has beaten or equaled the Dow every year since 1982. This year it's only been wrong twice, including the first week in January, when "Marley & Me" topped the box office and Forgrave predicted a bullish week. Instead, the market dropped five percent. Last weekend's box office winner was Tyler Perry's "Madea Goes to Jail", from Lions Gate . Based on its success, Forgrave signaled another down week on Wall Street. Why? This is a comedy! Again, he says genre is not as important as quality, which Forgrave called "average" for the film, not helped by its "predictable storytelling". It's a Wall Street version of two thumbs down—one for the movie, one for the market. Forgrave has certainly been right this week.

Last year, MarketBOB made the right call 35 out of 52 weeks, or two thirds of the time. The best call may have been the bearish predication made after "Beverly Hills Chihuahua" came in at #1 the first week of October, a light hearted film Forgrave called "lame". The market tanked 18 percent the following week. Of course, the fact that Lehman Brothers went under in mid-September might have had something to do with it. The worst call, however, was the following week, when the Chihuahuas still dogged the box office, and Forgrave predicted another bearish week. The market rebounded nearly 5 percent.

"Last year the movies were signaling BEAR for most of the year," Forgrave tells me, becoming "solidly negative" in summer once "WALL-E" was no longer number one. He says the bearish streak continued for 14 weeks, as Americans chose to spend money on dark, negative or cynical movies, like "The Dark Knight", "Tropic Thunder", "Lakeview Terrace", and "Eagle Eye" (I'm not sure I'd lump in "Tropic Thunder" with this group). He says the only bright spots were "High School Musical 3: Senior Year", which led to a 7 percent market run-up the following week, and "Twilight" which jump-started a 10 percent rally.

Forgrave says the only other time he's seen such a long streak of bearish movies was August through December of 1987, and we all know what happened in October that year. Box office winners back then included "Stakeout", about a cynical cop having an affair with the woman he's protecting, "Fatal Attraction", not a happy film, "The Running Man"--"death is a game", and the comedy "Three Men and a Baby". Forgrave predicted back then that "Three Men" would lead to a bearish week on Wall Street because movie-goers would feel ripped off--"What, three men can't look after one kid?". The market turnaround didn't start until January 1988, when "Good Morning Vietnam" was #1 for nine weeks.

"Maybe another breakthrough comedy will lead us out of the current market," he says.

Questions? Comments? Funny Stories? Email funnybusiness@cnbc.com