Amid a dry IPO market, Rosetta Stone's initial public offering is off to a positive start. The Arlington, Virginia-based company, which provides technology-based solutions for learning languages, raised $112.5 million during its initial public offering on Wednesday night, according to a report by Reuters. Shares of Rosetta Stone, which will trade at the NYSE under the ticker symbol "RST," were priced at $18 per share, marking the first IPO to price above its expected range in about a year.

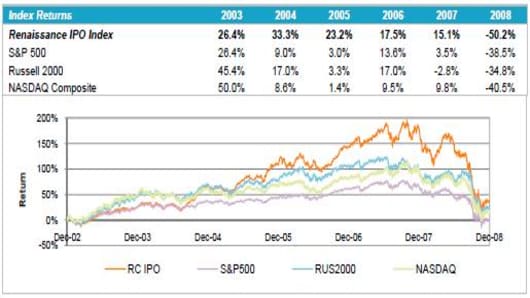

The average amount raised during an IPO during the first quarter of 2008 stood at $99.87 million, compared to $188.64 during the same period 2007, according to Renaissance Capital, an independent investment research company.

Rosetta Stone's debut brings the count of initial public offerings on a US exchange to four so far this year. In a sign of optimism, April has been the busiest month in the IPO market since July 2008, with three companies going public, including RST.

Setting the tone for Rosetta Stone , San Diego-based Bridgepoint Education, a higher education provider, sold 13.5 million shares during its initial public offering yesterday, raising $141.75 million. Shares of Bridgepoint Education , which were priced below the anticipated range of $14 to $16, closed yesterday at $11.10, up 5.71% for the day.

In similar deals this year, Chinese video-game developer Changyou.com , and baby-formula maker Mead Johnson Nutrition , saw their shares increase within the first few days of their IPOs. Since their debut this year, shares of Changyou.com are up 36.31%, while shares of Mead Johnson Nutrition are trading up 0.68%.