How many times have you heard the claim that the market always rises in the long term? It’s a dangerous and misleading market myth underscored by the deletion of General Motors from the S&P 500 and the Dow this week. The reality is that the top companies rarely remain top companies for extended periods when long term investment horizons are considered.

At the turn of the 20th century the top blue chip industries included buggy whip manufacturers. Their future looked assured, particularly if you ignored the new-fangled, noisy and slow automobiles that were successful only in frightening the horses.

Less than two decades into the 20th century the buggy whip industries had been superceded.

The first decade of the 21st century is witnessing a similar transfer of industrial and commercial power. GM is being replaced with Cisco — the Chevy's been routed off the road, replaced by the builder of e-networks, the next generation of highways.

Analysts and commentators trot out a chart display going back to 1850 to show the market in a consistently rising trend. The large falls in 1930, 1987, 2001 and more recently 2008, seem to disappear in this ever-rising trend.

The idea of constantly rising market is a compelling and attractive myth. This myth fails to distinguish between the behavior of the market index used to measure market performance, and the market itself.

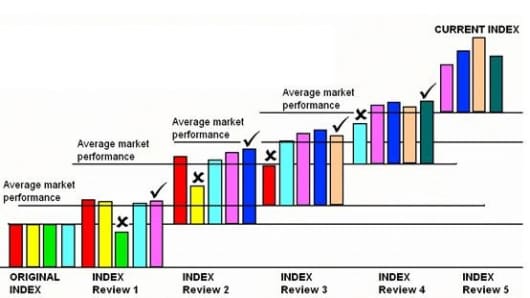

Survivor bias lies at the core of every index and the ever-rising trend. We start with a sample index with four stocks. They are red, yellow, green and light blue. The original index is constructed as the result of careful research. The objective is to locate the largest stocks by capitalization and the most important of the blue chip stocks.