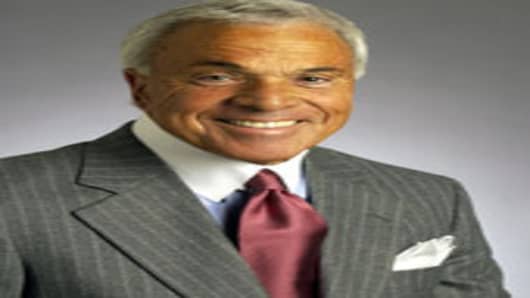

The SEC has charged Angelo Mozilo, the former chairman and CEO of Countrywide Financial, with insider trading.

The SEC also charged the company's former chief operating officer, David Sambol, and former financial chief, Eric Sieracki, with securities fraud for failing to disclose the firm's relaxed lending standards in its 2006 annual report.

As CNBC reported earlier, the charges were not accompanied by any criminal indictments.

Mozilo sold hundreds of millions in Countrywide stock in late 2006 and 2007 and is accused of remaining publicly upbeat about his company's prospects during a period when he knew things weren't going well for the firm. The SEC put the tally of his profits at $140 million.

Mozilo's attorney David Siegel said the stock sales "complied with applicable laws and regulations, and were made under the terms of a series of written sales plans which were reviewed and approved by responsible professionals."

"All of the SEC's allegations will be answered completely in court and disproved with the full facts and evidence," Siegel said in a statement.

Attorneys for Sambol and Sieracki also issued statements rejecting the accusations against their clients.

"The unfortunate reality is that this baseless complaint against Dave Sambol is the result of the tremendous political pressure the SEC is facing given its well-publicized enforcement failures," said attorney Walter Brown. "Making groundless allegations and losing in court will not help the SEC restore its reputation."