Q - DJIA 10,000 gets a lot of attention. Is this merited, should we care about this number?

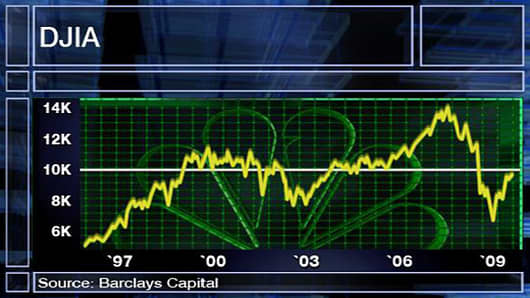

A – Yes, you should care but at the same time, don't lose track of the overall trend. DJIA has been a psychological barrier for the market since it first crossed this threshold in 1999. Since then, it has been a pivot for the market both to the upside and down.

Q - What do you mean by a psychological barrier?

A - All markets have areas where people tend to take profits or fade the move from a trading perspective. At the same time, overcoming these areas tends to be a psychological boost of confidence for the bulls in a trend going higher, for the bears in a trend going lower. New "handles" such as for example, 3.00%, 4.00% for ten-year rates, 1.2000, 1.3000 and 1.4000 for EUR/USD, Gold at 1000 etc, tend to be such pivots. Obviously, DJIA 10,000 falls into this camp.

Q - So does this mean crossing 10,000 is bullish for stocks?

A - It is a positive sign but remember that the primary trend of the market trumps any particular number or threshold. Equities have been rallying since Q4 2008 in some global equity markets, Q1 2009 in many others so the strength of this move likely implies further upside despite any back and forth that may occur around the 10,000 threshold.

Tune into Closing Bellfor full technical market analysis. Send us your questions toinvestoragenda@cnbc.com.

_____________________________

_____________________________

Questions? Comments? Write toinvestoragenda@cnbc.com