The Federal Reserve should raise interest rates now or the US economy will be faced with another bubble, Barron's warned in its cover story; but analysts told CNBC this will not happen.

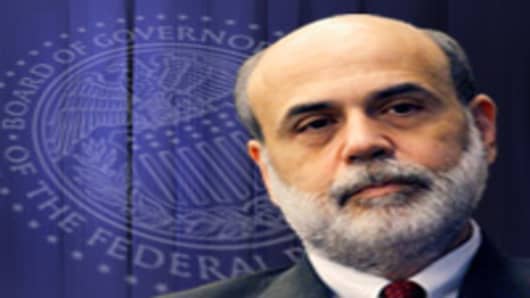

"It's time to raise the rates, Ben," ran the headline on the front cover above a picture of Federal Reserve Chairman Ben Bernanke.

The magazine is not alone in promoting this idea.

"I think that the US central bank should begin raising rates in December, I believe that the economy is strong enough for that," Dariusz Kowalczyk, chief investment strategist at SJS Markets Limited told CNBC.

"At the same time I'm sure they will wait longer because they will want to err on the side of caution," Kowalczyk added in an interview for "Worldwide Exchange."

Caution is the word, but also the economic indicators are not there yet, Jim O'Neill, head of global economic research at Goldman Sachs, told CNBC.