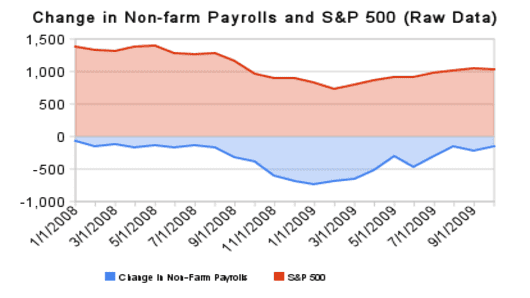

So the reason why the market has gone up since March even as the unemployment rate has climbed over 10 percent is because the pace of job losses have slowed since then. Which brings us very close to this point: Fewer job losses per month are no longer good enough to lift stocks higher.

For this rally to continue, jobs are going to have to start being created...and fast. Kelly believes job growth should be restored in the first quarter of 2010 if the trend shown above continues down a similar path. He's been generally cautious on the market lately though as he's awaiting a sign that trend will in fact continue.

Smart investors such as Richard Bernstein and Dennis Gartman watch the weekly jobless claims for an even more immediate status report on the job market. The problem is that from week to week that data can vary so you have to look at the trend there as well.

Looking at the correlation of that data to the stock market, these folks agree with Kelly that the belief some have about a magic "jobless recovery" that lifts stocks is just hooey.

Seabreeze Partners' Doug Kass, who nailed the March bottom in the S&P 500, believes that the jobs we are seeing lost may be gone for a long time and while the trend lately has been fewer job losses, that may soon reverse.

"We face a structural rise in unemployment that the markets have not yet accepted," wrote Kass, in his note today. This is not leading him to expect a return to the March lows, but he's taking profits and going short now in anticipation of a sizeable pullback.

The trading lesson here comes best from George Thorogood, if the landlady (the stock market) soon finds out this country "can't find no job", don't keep buying stocks, buy "one bourbon, one scotch and one beer."

______________________________________________________

Got something to say? Send us an e-mail at fastmoney-web@cnbc.com and your comment might be posted on the Rapid Recap! If you'd prefer to make a comment but not have it published on our website send your message to fastmoney@cnbc.com.